NEW YORK

The study, which I discussed previously, was based on a survey of roughly 200 employees at a large, presumably European, bank. Its timing, at least for the bank industry, could not have been worse, as bankers have only recently begun to mend the self-inflicted reputational damage suffered over the last few years.

In defense of bankers: But there is another side to this story -- namely, the bankers' side. The general argument is this: Because the study involved a small sample of bankers at a single bank, it should not be interpreted to reflect the integrity of the industry as a whole.

Here's how Frank Eliason, the global director for client experience at Citigroup (C), framed it in a post on LinkedIn:

- "The banking industry in the U.S., according to the latest FDIC quarterly report, employs 2,060,002. Worldwide, this number is much higher. ... No matter how you slice or dice the numbers, the reality is this is not statistical relevant sampling of an entire industry."

And here's how Emily McCormick, director of research at Bank Director magazine put it:

- "I take the conclusions of this study with a heaping dose of salt: Much of the results center on the employees of ONE BANK, and I have strong reservations about a study that is so influenced by the culture of one company. ..."

I've met bankers from all across the U.S., and I have a hard time buying that they're inherently more dishonest than those in any other industry.

I hope it goes without saying that Eliason and McCormick make a valid point. The results of the University of Zurich study don't gauge the integrity of the vast majority of bank employees who make loans and accept deposits in branches across the country every day.

Related: Shake Shack: Lessons to Keep in Mind for This Blockbuster IPO

Indeed, like McCormick, I have a hard time accepting that the typical banker is any less honest than the typical person in any other profession.

Yet I don't believe this invalidates the study. Quite to the contrary, I believe the study's results not only capture a genuine trait among a certain subset of bankers, but also reveal a fundamental truth about the current state of the industry -- namely, that a small but identifiable minority of bankers cause an inordinate amount of damage.

The poisonous influence of trading: I'm talking specifically about bankers who are either directly or indirectly involved in the world of trading financial instruments such as stocks, bonds, commodities, currencies, and derivatives. The problem with trading, as I've discussed elsewhere, is that it threatens to erode the relationship between a bank and its customers. At a traditional bank, a customer is entitled to a fiduciary-like duty. But among traders, a customer is an adversary, a counterparty.

"We didn't have the word 'client' or 'customer' at the old J. Aron," Goldman Sachs' CEO Lloyd Blankfein has said about the investment bank's metals trading division, where he worked for years with current Goldman President Gary Cohn. "We had counterparties -- and that's because we didn't know how to spell the word 'adversary.'"

Richard Marin, the former head of Bear Stearns' asset management division, made a similar point: "When you become arrogant, in a trading sense, you begin to think that everybody's a counterparty, not a customer, not a client ... [and] as a counterparty, you're allowed to rip their face off."

Related: Warren Buffett Tells You How to Turn $40 Into $10 Million

And, for good measure, here's Charlie Munger, Warren Buffett's partner and the vice chairman of Berkshire Hathaway, discussing the "poisonous" nature of derivatives trading operations:

- "We do not need [banks] doing this vast array of activities with this miasma of super profits and a lot of gross immorality in terms of the way that they deal with the customers.

- The derivative traders have tended to rook their own customers. That's not a pretty sight. It's a dirty business."

The contamination of retail banking: To be clear, the underlying issue is not that trading is inherently bad -- though, to Munger's point, it isn't the most ethical profession, either. Rather, the issue is that its adversarial ethos seems to have crept into the retail banking space through the 1999 repeal of the Glass-Steagall Act, which had banned federally insured depositary institutions from proprietary trading since the Great Depression.

For most banks, this is a nonissue, as only a minority of lenders are actively engaged in both proprietary trading and retail banking. Moreover, even the vast majority of employees at banks who do engage in both activities are, I believe, free of blame, as most of these people, to use Eliason's description, "are extremely honest and are working hard to improve the experience for customers every day."

But this leaves us with an insular minority of institutions and individuals who, in fact, have served as transmission agents of the trading ethos into retail banking. I'm referring specifically to current and former executives and other higher-ups at the nation's largest banks: JPMorgan Chase (JPM), Bank of America (BAC), and Citigroup. At least by my interpretation of the facts, the leaders of these organizations appear to have either explicitly or implicitly sanctioned the adoption of a trading mindset by their retail banking divisions.

Related: Social Security: 5 things to know before taking benefits early

Who's side are they on? What else explains the fact that, for many years, these banks surreptitiously reordered their customers' debit card transactions, presumably in order to maximize overdraft fees? Yes, I'm aware that the original theory was to ensure that customers' biggest and most important transactions, such as car and mortgage payments, cleared first. But this noble intent was at odds with the practice, which netted banks billions of dollars in additional income at the expense of their customers.

Then there are the misdeeds that were knowingly committed by the nation's biggest banks in the mortgage market prior to the financial crisis. Emails at all of the banks involved confirm that the malfeasance was intentional. For instance, here's how a Bank of America trader characterized subprime mortgages that were being packaged into investment-grade securities in 2007: "Like a fat kid in dodgeball, these need to stay on the sidelines."

And who could forget about the robo-signing scandal, in which these banks systematically submitted forged legal documents to courts in order to accelerate the foreclosure process and thereby potentially deprive their customers of shelter? Call me sentimental, but I've always believed defrauding a court of law is perhaps the most egregious type of corporate malfeasance imaginable.

Related: The Worst Mistake Apple Investors Can Make Right Now

Last but not least, few of the scandals to engulf the nation's biggest banks over the last decade betray their adversarial view toward customers quite like the allegations that they fixed ostensibly neutral credit card arbitration forums in order to effectively guarantee that their customers lost, irrespective of the facts. It is dispiriting, to say the least, to think that some of the biggest and most powerful financial institutions in the world colluded against their most vulnerable and downtrodden customers.

The industry's standard-bearers are the problem.

The point here is that there is more than a scintilla of evidence to suggest the University of Zurich study is onto something. To McCormick and Eliason's point, it most certainly doesn't reflect the character of the overwhelming majority of bankers around the country. But, unfortunately, the institutions and individuals that it does seem to reflect accurately appear in many cases to be the same institutions and individuals that, as a result of their sheer size and market share, are generally considered to be the standard-bearers of the industry.

John has written for The Motley Fool since 2011. Follow him on Twitter @OneMarlandRoad.

First Published: January 8, 2015: 10:10 AM ET

Royal Dutch Shell's head office is in the Netherlands.

Royal Dutch Shell's head office is in the Netherlands.

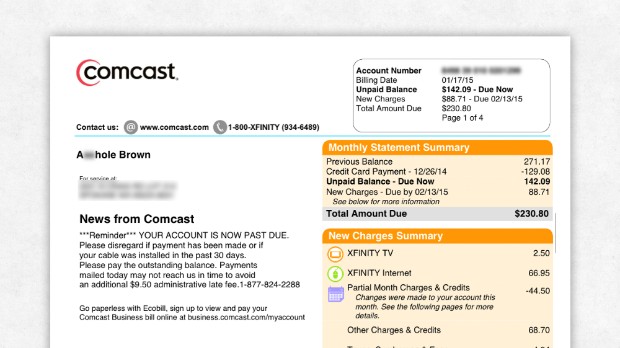

Comcast changed a customer's name to A-hole Brown, from Ricardo Brown, on a bill after he canceled the cable service.

Comcast changed a customer's name to A-hole Brown, from Ricardo Brown, on a bill after he canceled the cable service.  Taco Bell wants you to add your voice to a campaign for taco emoji.

Taco Bell wants you to add your voice to a campaign for taco emoji.

SpongeBob SquarePants is one of Nickelodeon's most popular shows.

SpongeBob SquarePants is one of Nickelodeon's most popular shows.  New England Patriots coach Bill Belichick talked about DeflateGate in front of a Gillette Flexball banner.

New England Patriots coach Bill Belichick talked about DeflateGate in front of a Gillette Flexball banner.

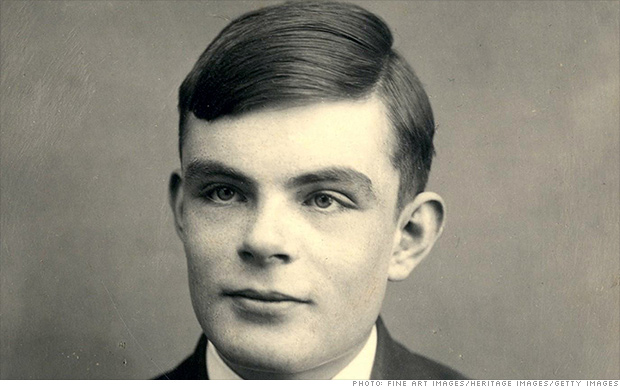

Alan Turing, the mathematician credited with inventing one of the first computers which was used to break the German military's code during World War II.

Alan Turing, the mathematician credited with inventing one of the first computers which was used to break the German military's code during World War II.  A new study shows that states with more college-educated people tend to have higher iPhone sales.

A new study shows that states with more college-educated people tend to have higher iPhone sales.  John Roberts lost his job to falling oil prices.

John Roberts lost his job to falling oil prices.  New apartment complexes like these are sprouting up all over the region.

New apartment complexes like these are sprouting up all over the region.

Melvin Gordon, who served as CEO until his death this week at age 95, is being succeeded by his 83-year old wife Ellen.

Melvin Gordon, who served as CEO until his death this week at age 95, is being succeeded by his 83-year old wife Ellen.  The high-profile schmoozing in Davos comes with a hefty price tag.

The high-profile schmoozing in Davos comes with a hefty price tag.

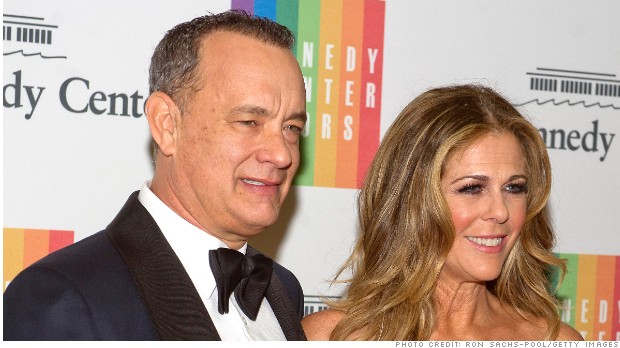

Tom Hanks, pictured with his wife Rita Wilson, applauded President Obama's plan for free community college.

Tom Hanks, pictured with his wife Rita Wilson, applauded President Obama's plan for free community college.  The future could be much bleaker than the vast majority of people have yet grasped.

The future could be much bleaker than the vast majority of people have yet grasped.  Notre Dame is saving $2.5 million a year after scoring the lowest rate ever for a corporate bond.

Notre Dame is saving $2.5 million a year after scoring the lowest rate ever for a corporate bond.  Marriott has pulled its FCC petition to block Wi-Fi hotspots in its hotels.

Marriott has pulled its FCC petition to block Wi-Fi hotspots in its hotels.

Caeful man, there's a beverage here!

Caeful man, there's a beverage here!  Oregon has it all: green spaces, bike friendly cities, food trucks and plenty of craft beer.

Oregon has it all: green spaces, bike friendly cities, food trucks and plenty of craft beer.