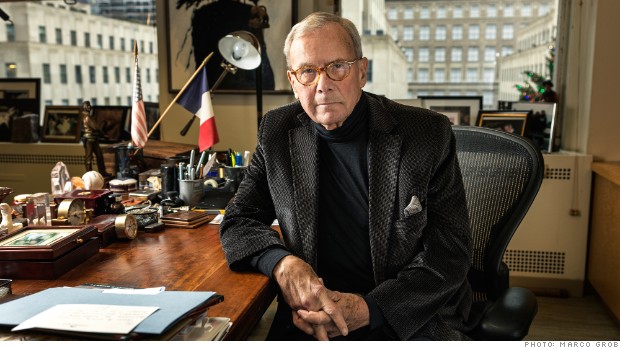

Brokaw in his office in Rockefeller Center in 2013

(Fortune)

Even now, at 74, he's still on the air at NBC for breaking news, as well as on special features for Today and for the recent Winter Olympics in Sochi. He has also become a bestselling author, most famously with The Greatest Generation, about those who came of age during the Depression and went on to fight World War II. That voice of his is probably the reason he's also the only broadcaster to earn treatment on The Simpsons, as well as on Family Guy, where his pronunciation of words with the letter l was hilariously parodied ("I'd love to lick a lemon lollipop in Lillehammer").

MORE: A giant of the broadcast generation - Brokaw in photos

These days, while working on a new book, Brokaw is also fighting multiple myeloma. He received that diagnosis last summer, after he was medevaced out of his 1,000-acre ranch in Montana with severe back pain. Brokaw says he was determined to keep the diagnosis private because "I wanted to concentrate on getting well -- and I didn't want to become the celebrity disease of the week"; but when the news was about to leak, he publicly disclosed the cancer in mid-January.

In a series of conversations with Fortune's David A. Kaplan, he reflected on more than 50 years in broadcasting and a personal life that early on hardly seemed destined for greatness. In his Rockefeller Center office filled with memorabilia of history and family, he talked about journalism, celebrity, public service, Warren Buffett, David Letterman, and who does the best Brokaw imitation. Edited excerpts:

Fortune: If a bus hits me on my way out today, this will be a perfect career bookend. I once interviewed Walter Cronkite for my high school paper. It was my first interview with somebody famous.

Brokaw: I adored Walter. I never was at CBS, but we ended up becoming friends. I was one of his eulogists. [Cronkite died in 2009, at 92.] Think about the adulation showered over him -- oh, man -- and the fame that came with it.

How did he handle it?

He loved being Walter Cronkite. There was nothing wrong with that because of the way in which he embraced it. I was a big fan. Think of the run he had, in the midst of whatever was going on: flying missions in World War II, Nuremburg, J.F.K., all the way to the end of the 20th century.

How did he come to know you?

I was unknown because I came to Washington from the West. I started covering Watergate. Immodestly, I'd say I did it pretty well, in part because it was hard to go wrong. Walter was keeping track. I remember the first thing he said to me: "I don't know anybody who can go out there without any script on a big complicated run of stories -- and just get it right."

Was he a mentor?

No. My mentor in the transition from the old Gabriel Heatter and John Cameron Swayze way of doing things was David Brinkley. He brought an entirely different style to what we were doing. He was able to sit at a desk on a night when all hell was breaking loose -- like for an election -- and with elegance in his language convey to you personally what was going on. It was one-on-one. We became quite close, in part because he realized I was tuning into him in a way the other correspondents were not.

Less so Cronkite or Huntley?

They were more old school. One time Walter came over here to tape something. We were having this great conversation, but when it came time for him to say, "On June 6, 1944," he went right into Walter Cronkite voice. [Brokaw imitates.] David didn't do that.

How did Brinkley do it?

There's a famous example. At their convention in 1968, the Republicans were trying to patch things up and arranged for [Richard] Nixon and [Nelson] Rockefeller to come in at the same time and walk through the crowd. And [NBC News president] Reuven Frank said into David's ear, "Give me a little something that will sum this up." And David said, "If that isn't love, it'll have to do until the real thing comes along." And then he shut up. He nailed it.

BEER, COEDS, AND MEREDITH

Do you love being Tom Brokaw?

Oh, you know, what's not to love? But not for the reasons a lot of people would guess. Fifty-one years ago I married an astonishing, gifted woman, Meredith.

You met when?

We were both 15. My dad was a construction foreman [for the Army Corps of Engineers], and we moved to a little town on the Missouri River named Yankton, S.D. I saw her picture. She was stunningly beautiful, gifted, smart, a cheerleader, a musician. She was a straight arrow. I was more than a bit of a wild child.

At 15?

Close. Anyway, she and I went through high school together and stayed good friends. She went on to become Miss South Dakota. I went completely off-track. I got interested in her, and she gave me what they now call the Heisman -- don't come near me. [Brokaw laughs and puts his arms in front of himself, as in the pose of the Heisman Trophy.] It was a handwritten letter: "I'm not interested." "I don't know what you're doing with your life." "Don't call, don't show up."

But otherwise it was positive?

It was a wake-up call. It was crushing to be rejected by Meredith. So I straightened out my life.

And she noticed?

About six months later, typical Meredith, she came to me and said, "I probably was out of line." I said, "No, I had it coming." We had a date that Sunday night. Six months later we were married.

What had you done to fix your life?

I quit drinking so much, and I showed up for life. I'd been just racing through. I don't want you to over-interpret this, but I was kind of a whiz kid: governor of Boys State, an athlete, the outstanding ROTC cadet. I was an enigma because when I decided to turn it on, I could hit it out of the park. I think part of what happened is I was just in overload in terms of expectations. A friend said, "You could ride that charm pony, Tom, all day long and get away with more than most people." And then I went off the high board. Meredith pulled me back. It's the single most important thing that happened to me.

It sounds like something you've thought about.

What I've thought about is, How in the hell did I let that happen in the first place? I once described my skid as an "ankle bracelet I continue to wear every day of my life -- wasting the opportunities that were given to me." I was drinking beer and chasing coeds every night.

Did you save that letter from her?

No, dammit, I didn't.

MIDWESTERN ROOTS

How did you adjust to fame?

Very easily. When I was 20 and in college and had my first job in television -- working weekends [for NBC affiliate KTIV] in Sioux City [Iowa] -- I was making $65 a week. People would see me outside a cafeteria trying to figure out what I could get for Sunday breakfast for $1.20. But they were very excited because I was on television, and they'd come over. They'd all had a good meal. They'd walk away, and I thought, "Well, that tells you all you need to know about the value of being a public person -- I can't afford to go into the cafeteria."

You get paid in compliments but not in coin.

That lesson never left me. It put everything in perspective for me. So I parked the whole business of celebrity at that point. There is a kind of radioactive celebrity these days, in which you become larger than you deserve to be. Everybody knows who you are, where you're going, and when.

How did you get your first full-time job?

I was lucky. There was a job at a station in Omaha [for NBC affiliate KMTV]. Bill "Doc" Farber made sure I got to the interview. This guy, right here [he points to a bronze statue on his desk, alongside two other statues, of Lincoln and Churchill]. He was head of the political science department at the University of South Dakota. He's still a heroic figure on campus; he may have turned out more Rhodes scholars than anybody in a school that size in the country. [Farber died in 2007.] We drove down together. I came home with the morning-news job.

Did you come across Warren Buffett in Omaha?

No. We've laughed about it. Meredith taught English at Omaha Central. She was very good at it. She taught with Warren's aunt. We like to say that we knew the Buffett who could diagram a sentence but not the one who was making a lot of people very rich.

And then you went to Atlanta?

I learned a lot in 2½ years in Omaha -- you would do the tornadoes, [Barry] Goldwater came a lot, one of the Wallendas fell from a sway bar and died -- but I wanted to get to the network. In 1965, I went to Atlanta [to NBC affiliate WSB], which was in the middle of everything. All hell was breaking loose in the civil rights movement. After six months NBC said, "You might as well come work for us."

In L.A.?

Yes. I was 25. In those days, the network operated differently. I wasn't just a local reporter -- I was part of the network team. I did a lot of reports for Huntley-Brinkley, and I briefed David on political stuff when he came out. I got thrown into fast waters. I worked hard. It was a great break for me -- the rise of [Ronald] Reagan, the Watts riots, the antiwar movement, the counterculture. I got to be a part of it and hold my own.

You're good-looking and have a baritone voice, but there was other network talent. Why you?

I had this unusual mix of curiosity, the ability to write in ways people understood, and when I appeared, viewers seemed to trust me to get them through some cataclysmic changes. In Los Angeles, I had the good fortune of anchoring the news right before Johnny Carson came on, so to see him the Hollywood stars watched me first.

Like?

Rob Reiner was one. Cary Grant, Henry Fonda, Roz Russell. Next thing you know, they're including Meredith and me in their social circle. Meredith had George Burns as a partner at a dinner party one night. We enjoyed it, but then we'd happily go back to our real lives.

IN THE ANCHOR'S CHAIR

After six years in L.A. you became White House correspondent and then host of Today before taking over as the anchor of NBC Nightly News, in 1982, for more than two decades. Is the anchor job different now?

There's much more of an emphasis on being known as a star today. I think people of my generation became journalists -- you know, right after the broadcast pioneer fathers -- because we wanted to report the big stories. I grew up at a time when if I had strayed, I'd get cuffed by people like Peter Lisagor [the Washington bureau chief of the Chicago Daily News in the 1960s and 1970s] or other print journalists who effectively raised me. We lived next door to Scotty Reston [of the New York Times], who would lean out his kitchen window and talk to me about what had happened at the White House that day. Those people became my models. It's just a different time and ecosystem now.

Are you at all ambivalent when you go on Letterman or Jon Stewart? News anchors didn't used to do that.

Walter went on the Mary Tyler Moore Show, but, no, I'm not. With Letterman, I know that we're going to drive hard on the news of the day in some fashion, and he's going to give me an opportunity to say things I'd like to say. It's on my terms. We have a good relationship -- he's an old friend.

Was 9/11 the biggest story of your time?

It was easily the toughest single story for lots of reasons, but the most enduring big story will be the collapse of the Soviet Union and the rise of China. Those are stories that can define an epoch.

When you say "toughest," you mean emotionally or reportorially?

Because you had to hold it together emotionally, you had to get it right, and you didn't know where you were getting it from a lot of that day. You were out there on the end of the gangplank, trying to keep the audience informed and not do something dumb. When the towers were still standing, having grown up around construction, I said, "At some point those towers are going to have to be brought down." And immediately I thought, "God, I've gone too far." And then moments later they came down.

THE BUSINESS OF JOURNALISM

You've been outspoken about the trajectory of journalism. Isn't there something salutary about having more news outlets?

I don't see myself as the generational scold. But I reserve the right to make observations, just as others reserve the right to make theirs. You know, I don't wake up in the morning and ask, "How do I nail them today?"

When you've counseled on-air to rein in commentary during election coverage, did you get off-air blowback from Chris Matthews or Keith Olbermann?

Keith wasn't happy with me because we would make these elaborate arrangements about how far he'd go, and then instantly he'd cross the line. I did think that on the night he told the President to shut the hell up that he'd gone too far. He may still carry a note I wrote to him when we first got going with MSNBC saying he'd done a very good job on election night with all the returns coming in.

He carries around the note?

He pulls it out whenever my name comes up: "This is what he wrote to me, and then this is what he said on the air." It's tiresome.

So Bob Costas carries around a Mickey Mantle baseball card and Keith Olbermann carries around a note from Tom Brokaw?

Yes, but Bob carries around Mickey in a sacred way.

Could you have been a print journalist? You still would've seen the things you saw, talked to everybody, visited exciting places.

That's a question I've asked myself a lot. But you have to remember that when I came into the field, broadcast journalism was exploding. Especially where I lived, the opportunities were far greater in TV and radio than in print.

If the Times had called to ask, "Come be a foreign correspondent for us"?

Well, I've been able do lots of print. Not just the books, but op-ed and magazine pieces over the years: about being there when the Berlin Wall came down, about health care for veterans.

It sounds as if it's an irritant that you're not given enough credit for your writing abilities.

It's a mild itch at best.

If you had been a print journalist, how much would you have missed being on the box?

A little bit. The box gives me a kick. It's a different verbal skill set altogether. It's my natural place to be.

Thinking on your feet?

Right. At the end of the day, what you're doing is just trying (1) to get it right, (2) in a way that engages people, and (3) make sure it lingers. You can do that in the printed word, but it's not the same.

But you appreciate the appeal of writing.

Books are changing too. I'm thinking about a new one, and I'm looking first at forms. Tom Friedman [a New York Times columnist] and I had a three-hour dinner with Jeff Bezos [the CEO of Amazon] this summer about the range of choices now available in electronic publishing. It was just before his [Bezos's] purchase of the Washington Post was announced. Not a peep from him -- Tom and I laughed what ace reporters we were.

If you were 20 again, would you still head toward TV?

I might go to work for Bloomberg because they've got so much range. They're on television, they're digital, they're business, they're political. They're the biggest presence in Washington. But I seem to have the tools for exactly what I've been doing for 50 years, so I'd probably do it again.

Is news too fast now?

Look at all the tweeting stuff. My wife and I were in an auto accident [in 2009]. It could've been very serious for us. Tragically, a woman was killed. The next day, when you typed in our names in Google, there were about 200 websites referring to the accident.

Whereas 20 years ago ...

The auto accident would've gotten a line or two in the Daily News, and that would've been it. But not 200 hits. And then everybody's invited to comment!

Part of that isn't increased curiosity -- only technology enabling its fulfillment, no?

No, the web has created it.

Are you described the new world or lamenting it?

It is a reality, and I'm lamenting it. But I'm also embracing it. I'm not going to turn things back. What's missing is dialogue among us. There isn't a nanosecond between what happens and what people say about it and then a reaction to that. I would like to see more use of the digital universe for fact checking, for contemplative discussion.

LINDSAY LOHAN AND THE TODAY SHOW

Have you relented on the matter of White House Correspondents Dinners?

Are you kidding?

I'm just checking. So you didn't go this year?

[Laughs.] No. I hate it in a way that I can't adequately convey. I have a reasonably manageable ego, but I can't believe people see this as a wonderful exercise. It's so repulsive and so antithetical to who we should be. It's astonishing. It really is.

Do you find yourself revisiting this issue a lot?

I had a memorable moment during a dinner in my early days. It was a different culture in the ballroom, with people who had something to say: Lee Iacocca on my right and P.X. Kelley, the commandant of the Marines, on my left. Across from me was Philip Hart from Michigan, one of the last of the great senators. We were having a good time, laughing back and forth. And he looked at me and said, "Mr. Brokaw, how old are you?" And I said, "I'm 33." And he said, "That's just great." It was a snapshot of a moment. You don't have those anymore, where a senior senator says to a young correspondent, "I want to know a little bit more about you."

Now you can have Lindsay Lohan saying so!

I mean, how much worse can it be than to get Lindsay Lohan?

Any thoughts on the current travails of Today?

Yeah, but I'm not going to share them with you. [Laughs.] You think things are tough now? When I took it over in 1976, it had been a monopoly for 25 years. They had not changed a writer or producer or concept. And then Good Morning America came along. I was a traditional newsman. Jane Pauley [the new co-host] was, you know, barely out of college. I remember one morning we had a harpsichordist on in a long gold brocade dress. And even I understood this wasn't how you produce a morning show.

What happened?

We went down hard. GMA took over. And then Steve Friedman came in [as executive producer] and said we'll get this thing back on top. Politics is probably my strongest suit, and we caught the wave going into [Ronald] Reagan's election in 1980.

Are Today's problems cyclical?

They're not. But it's like fashion or music. You lose your touch. I talk to the staff about it. The other day they were really hot. You had Matt [Lauer] on with a really good interview with Justin Timberlake. And they had Sting in the studio doing a song. They're retooling, and they'll be back.

Better than a harpsichord?

Yeah, better than the harpsichord.

Do you watch The Newsroom on HBO?

A little bit. It's a well-scripted show, but I don't think it touches what we do. It's Aaron [Sorkin's] wish that newsrooms would behave that way.

What do you read every day?

I'm a hopscotcher -- I read around. I Google a lot of stuff. I don't read print newspapers as much as I used to. Politico. Sometimes Redstate and BuzzFeed. I've got to stop the middle-of-the-night reading because it's just too easy to wake up and reach over and get your iPad and get hooked.

You retired in 2004 at 64. In retrospect, was it the right call?

When I left, part of the reasoning was seasonal. I wanted to be able to go pheasant hunting in the fall, which is a sweeps period, and I couldn't take days off in the middle of the week. I wanted to go fishing for steelhead in British Columbia, biking in New Zealand. This year alone we were in Africa for a week, and trips to Argentina, Chile, and Antarctica. And we spend a lot of time in Montana. I didn't want to wait until I was 75 or 85. My back was a reminder that time is catching up with me. [That back pain was the key indication of the onset of multiple myeloma.]

How are you doing with your health?

I'm encouraged with the progress I'm making in treatment. But I do want to keep it a private matter.

THE GREATEST GENERATION

Why did you get interested in writing about the military?

I wasn't actually there on the 40th anniversary of D-Day. I was on the beach a little earlier. Sam Gibbons, a congressman from Florida, came over to me and pulled out a cricket that the 101st Airborne carried. It went click, click. Gibbons said, "I was here 40 years ago." And I said, "Tell me what happened." As he did, tears started streaming down his face. His wife came over and said, "Sam, you don't have to do this." He said, "Yes, I do." He told stories the next half-hour she'd never heard before.

That was the impetus for The Greatest Generation?

It took me a while. I started collecting these stories. I was scheduled to write another book for Random House but told them, "I have this other idea." And they said, "Stop what you're doing and do that."

It was an epiphany?

It was. In fairness, I road-tested it. I did it in commencement addresses several times. It was at Yale Class Day that I called it "The Greatest Generation."

Your phrase?

Totally my phrase.

Why did the book work so well?

Ken Burns has the best line about me. He said, "You gave them permission to talk."

Why are people comfortable with you?

I've never understood it. I think Midwesterners -- the Johnny Carsons, the Harry Reasoners -- do well because we grew up in the middle of the country. We look both ways, east and west, north and south. [Someone] said I have an affidavit face -- "You look at it and know he's telling you the truth."

THE VOICE

Who does the best Brokaw imitation?

Ed Helms, the guy who used to be on Jon Stewart. I don't even know him. One night Letterman turned to him and said, "Say it: 'Meredith and I want you to come visit us at the ranch, David.' " He did me pitch-perfectly.

I can't remember Peter Jennings ever being done.

Mine is distinctive. It's gotten me where I am. I can't complain.

First Published: March 20, 2014: 9:40 AM ET

![]()