Lululemon founder Dennis "Chip" Wilson, seen here climbing Grouse Mountain in Vancouver, is scrambling to find a new CEO.

(Fortune)

It's a rare moment of inner peace at Lululemon (LULU). The athletic brand, a longtime darling among urbane yogis and momentum investors alike -- it's making its third consecutive appearance on Fortune's Fastest-Growing Companies list, at No. 21 -- is having an uncharacteristically unfit year: In March the company pulled a large batch of its signature black yoga pants for "an unacceptable level of sheerness." (The episode became fodder for a skit on Jimmy Kimmel's late-night talk show, and the company compounded the problem with its earnest clarification: The transparency could be spotted only if customers put on the pants and bent over.) Three months later CEO Christine Day announced plans to resign with little explanation, telling Fortune, "My values include discretion." The management uncertainty shook investors, and the stock fell 20% in the days following the announcement, wiping out some $2 billion in shareholder value.

While the company has taken pains to portray the two events as unrelated, the sheerness incident and the management upheaval have blemished Lululemon's fashionable façade. Interviews with former and current executives, including Day and founder and chairman Dennis Wilson (he goes by "Chip"), paint a picture of a 15-yearold company that is struggling to mature, though it has $1.37 billion in annual sales and 218 stores worldwide. Lululemon is pouring resources into its brands for men and girls and plans to add 38 new stores this year, even as it is scrambling to make investments in inventory and supplier-management systems. The corporate culture is shaped by an unusual development program (more on that later), giving headquarters an insular feel -- a vibe that is amplified by the fact that Wilson has installed neighbors and family members in senior positions. The tension at the top is palpable. Day, a former Starbucks (SBUX, Fortune 500) executive who joined the company in 2008, and Wilson, an entrepreneur with big ambitions, have few nice things to say about each other. In separate exclusive interviews with Fortune it is clear that their relationship has soured beyond restoration.

MORE: 100 Fastest-Growing Companies

Lululemon is actively searching for a new CEO, and when one is found Day will officially step down. (The company does not dispute her assertion that she is leaving voluntarily.) What isn't clear is the role Wilson, 58, plans to play once a new leader is appointed. The charismatic but sometimes unfocused entrepreneur (colleagues say he has trouble sitting still and has conducted business meetings on stationary bikes) has dipped in and out of daily affairs at Lululemon throughout its history. He says he doesn't want to be CEO, but his fingerprints are all over the company's policies and principles.

Tellingly, Wilson offers a Zen-like perspective on Lululemon's recent fumbles, comparing the company to a rebellious teenager. "It needs to go through that stage where it's growing up on its own, and the internal management needs to make some of its own mistakes," he says in an interview at his palatial Vancouver home, "or it won't get to that healthy company that I want it to be 30, 40 years down the road." Lululemon has proved that it can grow. The question is, Can it grow up?

Chip Wilson says one of the reasons he started Lululemon was precisely to avoid the sheerness problems that plagued the company earlier this year. Leaving his first yoga class, he noticed that his fellow students' pants became see-through when they bent over to roll up their mats. Wilson had recently sold his surf, skate, and snowboard clothing company, Westbeach, and saw an opportunity to bring to yoga his expertise with so-called technical athletic apparel.

MORE: Inside Lululemon's Headquarters

His approach was groundbreaking. Pre-Lululemon, retailers tackled women's fitness clothing by cutting down the size of men's styles and offering them in feminine colors -- what the industry calls "shrink and pink." Wilson believed that women didn't want to work out in ill-fitting T-shirts; the company created a fictional muse named Ocean, an affluent, fit, educated 32-year-old, to inspire its designers. The name Lululemon also sprang from Wilson's imagination: He had sold a Westbeach division, Homeless Skateboards, to a Japanese buyer for a large sum and thought the brand's appeal stemmed from the letter l in the name. For his new venture he invented the word Lululemon in the hopes it would fetch a good price someday. The whole concept -- the fashion-forward style, the funky-sounding name -- combined with Lululemon's technical elements (seamless stitching and breathable fabrics), connected with consumers, and Wilson found he could charge $100 or more for workout clothes.

As its popularity grew, Lululemon's inability to keep up with demand actually created buzz and helped drive traffic to its stores because women knew sold-out items wouldn't be restocked. The company follows a pyramid model for designing and stocking product -- just a few "wow" items, representing the pinnacle, which sell out in four to six weeks; seasonal items in the middle; and staples, such as yoga and running pants, at the broad base. The company sells primarily through its website and stores in tony spots such as Aspen and East Hampton, which have plenty of flexibility in decor and marketing. The formula is working: Last year research firm Retail Sails reported Lululemon's sales per square foot as the third highest in U.S. retail, behind only Apple (AAPL, Fortune 500) and Tiffany (TIF).

The stores, the design -- all the creative stuff -- consumed Wilson and the company in its early years. "Product was the No. 1 focus -- certainly the culture, the store experience, all of those things," says John Currie, Lululemon's chief financial officer since 2007. "[Wilson] actually said this to me: He hadn't really invested in those areas that don't add value, like finance, IT, HR." As the company grew, those less glitzy functions remained underdeveloped. When Kathryn Henry became chief information officer in 2010, she says she was surprised to find back-office systems suited for a $200 million to $300 million business, not one twice that size. It was not unusual for operations to run on Excel spreadsheets. The lack of infrastructure actually allowed Henry to accelerate her deployment of support technology because she didn't have many legacy systems to contend with.

MORE: Do you speak Lululemon?

But not all transitions have gone so smoothly. Former executives say Lululemon still lacks a rigorous manufacturing model. If designers need more time to work on a product, they take it, despite the pressures it puts on the production calendar. (The company counters that the calendar is structured to be flexible.) The production department is staffed for a much smaller company: About two dozen employees in Hong Kong and Taipei oversee 90% of the manufacturing of its 30 million units of product a year. Several onetime executives said Lululemon lacks people who have expertise in the technical aspects of clothing manufacturing, such as quality control and raw materials, but the company is working to add this bench strength.

The stresses became visible in March, when Lululemon pulled the yoga pants from shelves. The company regularly saw a 1% complaint rate about sheerness in its popular Lycra-nylon blend, called Luon, but complaints climbed to 12% for the batch released earlier in 2013. It turns out the Luon debacle wasn't Lululemon's first product glitch in the year. Customers also encountered bleeding dyes on brightly colored items and, embarrassingly, a small batch of swimwear that turned sheer when wet. But the Luon blunder hurt a core product, affecting 17% of inventory, and the recall could cost the company up to $67 million in revenue this year. "You really can't make mistakes, especially when you're charging $100 for a pair of pants you're going to sweat in," says Morningstar analyst Jaime Katz. Lululemon's rabid customers took to the web in response. A company blog post on the incident elicited about 200 comments, and a post on the Lululemon Addict blog called for Day's head, saying she "has ruined everything special about Lululemon."

MORE: 7 Fastest-Growing techs

The Luon issues were a serious wake-up call to management. "We probably weren't growing that quality-control part of the company as fast as the company," says Wilson, "and we made a mistake." Lululemon was building up its quality team when the Luon flap hit. The sourcing group has added two new suppliers for Luon and tightened its specifications for the fabric. After two years of development, Full-On Luon, the next generation of the material, was introduced in July to positive customer reviews.

To some in the outside world, the Luon incident wasn't just a quality problem but an indication that Lululemon was, well, stretched too thin. "The company has overleveraged its infrastructure, is overearning, and the company's well-above-industry-average operating margins reflect this," wrote Buckingham Research analyst John Zolidis. "We believe either Lulu will need [to] slow growth to catch up on infrastructure spending or execution-related risk will remain elevated, possibly resulting in even more problems down the road."

Every morning, Chip Wilson convinces himself that his life -- or his company -- is not working and something must be fixed. He's petrified of mediocrity. "If I don't look at the world from that point of view, the world's going to pass me by," he explains. The 6-foot-3 fitness buff is obsessed with self-improvement. He has pledged to run the Grouse Grind, a vertical trail in Vancouver that climbs 2,800 feet over 1.8 miles, as many times each year as his age (this year he is running it 58 times). Yet he speaks with the soothing tone of a yoga instructor, a notable contrast from the chaotic energy sparkling in his steel-blue eyes.

Wilson didn't have an easy childhood. His parents divorced when he was 12, and the family struggled with money. He felt he could rely only on himself for survival (he once forged one of his mom's checks to pay for a meal at the grocery store), and that thinking followed him to adulthood. He says he later learned that this mentality -- his need to fully control most situations -- was hurting him as a manager.

MORE: 15 years of rapid growth for our Fastest-Growing Companies

Wilson discovered his professional and personal weaknesses through courses taught by Landmark, a for-profit leadership-development company started in 1991 by former employees of Werner Erhard & Associates. (Erhard is best known for developing est training in the 1970s.) "I started up a couple of companies, but I could only get them to a certain point, and they would virtually go into bankruptcy because everything had to go through me," he says.

Landmark was so transformational for Wilson that he built it into the foundation of Lululemon. Employees who have been at the company for a year are offered a three-day Landmark Forum seminar. "While Landmark is optional, the things that people learn in Landmark are not optional," SVP of people potential (that's Lulu-speak for head of HR) Margaret Wheeler explains. But onetime employees said it was professional suicide not to take the course. New-hire orientation echoes Wilson's obsession with goal setting, and all employees post one-, five-, and 10-year personal, professional, and health targets on the office walls -- things as personal as weight-loss goals. It's a culture that's clearly not for everyone, and some former executives claim it was both cliquish and a big professional adjustment.

Wilson says Landmark helped him realize that he needed outside assistance to run the company. In 2005, with revenue approaching $100 million, Wilson brought in private equity investors, and with them former Reebok executive Robert Meers to lead the company. Meers was there to oversee the IPO, but Wilson says that he was not a strong fit culturally; Meers pushed aside Lululemon's founding employees, bringing in his own people. "We didn't really have access to [Meers's] team to bring them the gift of our culture, the gift of Lululemon," recalls Deanne Schweitzer, SVP of creation. Meers says he accepted all employees, creating camaraderie and a results-driven organization. "I felt that this whole Landmark-speak that Chip embraces was platitudes. There was no meat on the conversation," he says. "I find Landmark preaching inclusion but practicing exclusion and elitism."

MORE: Fastest-Growing and in it for the long haul

Lululemon began looking for a CEO who had the operational skills to scale the fast-growing company, as well as a deep appreciation for its culture. Day had just left Starbucks, having spent much of her career working with Howard Schultz, another involved, passionate founder. She seemed to be an ideal match for Lululemon and joined the company in January 2008 as EVP of retail operations. Six months later she was named CEO.

Day says she tried to realign the business to match Wilson's original vision. She supported the company's group of founding leaders, sending three original employees, who are all Wilson's former neighbors, to executive business programs. Wilson's sister-in-law, Susanne Conrad, was the only person trained to run the company's leadership-development program, so human resources had her certify 26 employees to do similar work. (Wilson's 24-year-old son also works for Lululemon; he's creative director of the men's line.)

Wilson stayed on as chairman and chief product designer when Day joined the company and in 2010 moved into the new role of chief innovation and branding officer. Former employees claim Wilson tended to zoom in and out, creating confusion about who was in charge. "For the first time, I recognized that I wasn't getting out of the way," he admits. "I was actually doing a very mediocre job of being an employee and a mediocre job of being a chairman of the board." In January 2012 he stepped down from his executive role and moved his family to Australia. Wilson focused on becoming a better chairman, taking a four-day board-governance course at Northwestern University back in Evanston, Ill.

MORE: Meet the world's fastest growing fitness chain

Wilson was in Australia when the company issued its pants recall -- news that Wilson says made him "absolutely sick." He would have handled it differently, he says, and the company learned some lessons about taking full responsibility right off the bat. Wilson returned from Australia in May, and Day announced her resignation weeks later.

Day, while not referring specifically to Wilson, offered this observation on founders: "You either have to be really in, and in the job as a CEO or another functioning member of management, or 'peace out.' The hardest place is someplace in the middle where you try to do parts of other people's jobs."

Wilson and Day's working relationship had clearly deteriorated to a point where they could not coexist. Neither would discuss anything related to Day's resignation, but their differences go beyond the Luon fiasco. Even their efforts to praise each other end up as backhanded compliments. Wilson says Day "did exactly what we asked her to do, and that was to replicate a perfectly set up organization that just needed basically the knowledge of how Starbucks replicated what they did." Day says: "Chip planted some amazing seeds, but some weeds were starting to grow."

After the board finds her replacement, Day intends to take time off and then build something else. "I've got one more in me," she says. Wilson, meanwhile, has no plans to go anywhere. "Lululemon is a culmination of everything I've ever done in my life, and I'm here for the long run," he explains. As for the company's next CEO, Wilson wants someone with apparel experience. In July, when Coach executives Mike Tucci and Jerry Stritzke (a Lululemon director) announced plans to leave Coach, there were rumors that one of them might end up as the board's pick.

MORE: For-profit universities prosper

The next CEO of Lululemon will have to fend off a new wave of competitors, many of whom are taking a page from Lululemon's playbook. Athleta, a unit of Gap, offers similar fashionable workout gear at a slightly lower price point. Barclays analyst Matthew McClintock estimates that Athleta had more than $250 million in sales last year. While that's a fraction of Lululemon's revenue, Athleta would probably have little trouble expanding its operations by tapping into Gap's network of suppliers, distributors, and more.

Many of Lululemon's challenges are typical for fast-growing companies. Silicon Valley startups deal with tension between founders and professional managers all the time, and nearly every hot company struggles to keep up with demand at some point. If Lululemon can work through its growing pains, the company's future looks bright: Ivivva, a brand for girls, has only about a half-dozen locations, but already its sales-per-square-foot figure puts it in the top 10 U.S. apparel companies. Lululemon's international market has the potential to be as big as North America's, and the company is experimenting with small lines in areas like tennis, golf, cycling, and swimming.

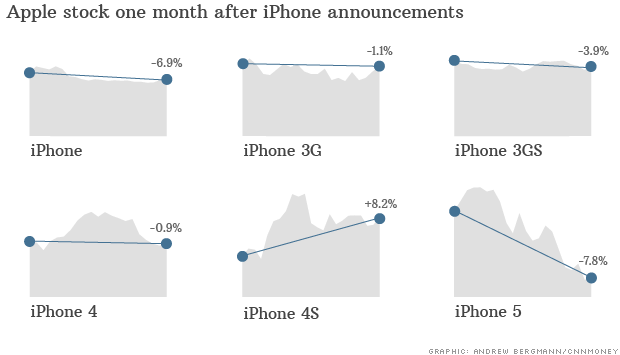

The new CEO of Lululemon may want to take a page from another fast-growing company with a demanding founder. Apple has managed to become a mainstream brand without losing its cult appeal and has been as meticulous about execution as design. Supply chains may not be as glamorous as building a store in the Hamptons, but they are the hallmark of businesses that outlast their founders.

This story is from the September 16, 2013 issue of Fortune.

First Published: August 29, 2013: 8:00 AM ET

![]()