An ex-cop comes to the rescue

Written By limadu on Kamis, 28 Februari 2013 | 23.53

The luxury hunter

Jaume Tàpies at El Castell de Ciutat, his hotel (and home) in Andorra

(Fortune)

My survival skills

Cultivate hobbies. I used to be a competitive skier. Right now I'm a pilot. And I play the guitar. What you do that isn't work opens you up, lets you in. In Durban [South Africa] I ended up playing my guitar at a country-music festival.

Embrace solitude. Many times I'm on my own, but these moments of solitude give you a lot of freedom -- I can go right, I can go left, I can stop and eat a hot dog off the street in New York, which I did. Why not? It's about the curiosity and the freedom.

Study service. I live in a ninth-century castle on the border of Andorra and Spain. That's home -- my hotel. The difference between a good hotel and a bad one is one word: care. Find people who care and you will have a great experience.

Avoid nonspots. You lose time in what I call nonplaces -- an airport, a station -- time when you could be seeing and doing other things. Never eat on planes. Eat before. Then walk. Then get on the plane.

Catalogue the day. I do this every night: write in my black notebook with my Mont Blanc pen everything that happened that day. Mostly I write about the people I met -- you will be in there! One day I'll look back and be able to trace this incredible history, but it also helps me remember where I've been.

This story is from the March 18, 2013 issue of Fortune. ![]()

First Published: February 28, 2013: 10:41 AM ET

Banana Republic: Turning khaki into gold

Patricia and Mel Ziegler at home in Mill Valley, Calif.

(Fortune)

Mel Ziegler: I grew up in Scranton, where my father had a small wholesale business selling tobacco, cigarettes, and candy. We had no money. My mother was good at making it happen on limited means.

Patricia Ziegler: My father is from Wales, my mother is Italian, and I grew up in San Francisco. My father worked three jobs, and there was no money. I was an art major and moved through schools and communes as a free spirit until I needed a job.

Mel: For me, journalism was an interesting and lively way to make a living. After graduating from the Columbia Graduate School of Journalism, I finished a book with Bella Abzug about her first year in Congress. In 1972 I drove out to visit a friend in San Francisco and ended up falling in love with the city. Those were the years of the Patty Hearst kidnapping, drive-by shootings on the streets, and the Zodiac killer.

Patricia: I was working as an illustrator for the San Francisco Chronicle when I met Mel at the company Christmas party in 1974.

Mel: We were in our twenties, and both of us wanted to see the world. By 1977 we were talking about leaving the paper. One day, Patricia came home and told me she'd just quit. I had quit earlier that day. We're very tuned in to each other.

Patricia: We were excited, but discovered that freelancing wasn't steady work.

Mel: Then I got a magazine assignment in Australia and walked into a surplus store in Sydney. I found an amazing cotton khaki jacket that looked like a safari jacket. When Patricia picked me up at the airport, she immediately saw its possibilities.

Patricia: I decided to make some improvements. So I added leather elbow patches, took the flaps off the bottom pockets, and replaced the brass buttons with wooden buttons. It took it out of a military context and into a safari style. Mel wore it everywhere, and people asked, "Where did you get that jacket?"

Mel: We found a huge cache of all kinds of surplus and decided to sell it in a new context, as cool clothing for people who didn't give a damn about fashion.

Patricia: We found a pile of old Spanish paratrooper shirts in an Oakland warehouse, haggled a bit, and got 500 of them for $1.50 each. We went to a flea market that weekend but sold fewer than 10 shirts all day. So we decided to double the price and call them Short-Armed Spanish Paratrooper Shirts. We sold more than $1,000 the next day, and Mel said, "We need a store."

Mel: So about six weeks later, in November 1978, we negotiated a lease on a store way off the track in Mill Valley. We went like lightning, even though we didn't have any money.

Patricia: Having no money was a great asset because we had only our imagination.

Mel: We didn't know anything about catalogues, retailing, or selling things. We had $1,500 and an American Express card. We were able to negotiate credit, so we kept ahead in the cash-flow department.

Patricia: Mel is more conceptual and strategic. He did the marketing and publicity, set up the accounting procedures, and kept the overview of things. I was the production person, merchandiser, designer, and artist.

Mel: We came up with the idea of Banana Republic by fantasizing about the source of our merchandise. We invented a world in our catalogue that quickly found a following. In the beginning, every day was about making enough money to survive. In 1979 we charged $1 for the catalogues. We'd work until we were exhausted, go home, open the mail, and take the dollars from the envelopes to go to dinner.

Patricia: The people who worked for us were on minimum wage, but everyone had creative freedom, and we had a good time.

Mel: We didn't have any investors, and by 1983 we were doing $2.5 million a year in revenue. One of our best customers, a real estate developer named Merritt Sher, kept asking to put a Banana Republic in one of his shopping centers, but we didn't have the energy or the money. We said if we could, we'd sell the company. Within 24 hours he had us talking to Don Fisher, who owned the Gap (GPS, Fortune 500).

Patricia: Army surplus wasn't going to last forever. Gap had the money and factory connections to let us do our own private label.

Mel: When Don's CFO saw that our margins were north of 80%, he accused me of lying. But we were just finding other people's junk and turning it into gold. So Gap acquired Banana Republic Inc. on Feb. 1, 1983. We owned a percentage of the gross margin as long as we stayed. Later, we changed it to a percentage of the sales.

Patricia: The only reins we turned over were operational, accounting, and legal, the things we didn't like to do. Don gave us autonomy. We could open a store, no questions asked, as long as we were profitable. In Beverly Hills, I wanted to do a panorama of Africa, so we had a bush plane flown in and wheeled it up Santa Monica Boulevard with a police escort.

Mel: It was the 1980s, when Indiana Jones and Out of Africa were very popular.

Patricia: We had a strong message. Before, there were working-class clothes and designer clothes. We came along and said these are clothes for individuals. If you have a sense of romanticism and adventure, we're your brand. If you go shopping, we're going to entertain you.

Mel: Banana Republic grew exponentially, from two stores to 100, and began to show up as a few cents per share on the earnings of the Gap. Don and others began to worry that what we were doing was just a passing trend. In September 1987, Gap missed earnings, and in October the market tumbled on Black Monday. Don's people wanted to turn Banana Republic into a higher-end Gap. So in 1988 we left. Banana Republic had annual revenues of $250 million then.

Patricia: After that, we had our first child, and Mel decided to go to a meditation retreat.

Mel: I was a coffee-drinker, type A kind of guy, and at the retreat you sat in silence for 10 days. They didn't have any coffee, and I got a terrible headache. The goal of meditation is to stop thinking, and anytime I couldn't stop thinking, the thought of a tea business came into my head. So not knowing anything about tea, we jumped into the business.

Patricia: I started mixing together teas with different flavors in the kitchen and designing packages.

Mel: In 1992, Doubleday published our book, The Republic of Tea, and the advance served as funding for the launch of our next republic. In the early '90s we became America's first full-leaf tea company.

Patricia: Having children changed us. With Banana Republic, we were so full of youthful energy and worked around the clock. Realizing how quickly our two children were growing made us want to savor the moment.

Mel: We love inventing things, but we don't love running things. We ran Republic of Tea for two to three years, then sold it to Ron Rubin [founder of New Age Beverages]. Now we're inventing a new business in the healthy packaged food category.

Patricia: Everything's a creative process with us. We wrote Wild Company to illustrate to our children and other young people wanting to take charge of their lives that creativity, chutzpah, and imagination can work wonders even without money or experience. In the process, Mel and I rediscovered how much we love working together as a couple. Every day is a new discovery.

Our Advice

Your customer is your best asset, so overdeliver. Our clothes were always better than they needed to be. The fabrics were so good, people are still wearing them 30 years later.

Never take no for an answer. When the Stanford Shopping Center sent us a list of design rules for our first mall store, our design broke every rule, and we sold more per square foot than any of the other apparel retailers in the mall.

Be authentic. Everything that's successful is intensely personal because you give your whole self to it -- your talents, your tastes, your aspirations. If you put that out there, you become a presence that will not be ignored.

This story is from the March 18, 2013 issue of Fortune. ![]()

First Published: February 28, 2013: 10:42 AM ET

Rebooting the dashboard

(Fortune)

1. Video calling. Cameras mounted in the dashboard allow for placing and receiving videoconference calls, much like Apple FaceTime. In Bentley's implementation, video calls work only when the car is parked. Shifting into gear transfers the call to voice only.

India to tax rich, luxury cars

Mumbai's sports car enthusiasts will pay more as India raises duties.

NEW DELHI (CNNMoney)

Finance Minister P. Chidambaram said he had no choice but to impose a 10% tax surcharge for one year on taxable income of more than 10 million rupees, or about $186,000. Some 42,800 taxpayers would be affected, he said.

"When I need to raise resources, who can I go to except those who are relatively well placed in society?" he said in a speech to parliament Wednesday.

Chidambaram doubled an existing surcharge on some domestic firms to 10%. Foreign companies that already pay a higher corporate tax rate will face a new surcharge of 5%, up from 2% at present.

Duties on sports utility vehicles, yachts, expensive motorcycles and luxury cars will also rise as part of India's drive to cut its budget deficit to 4.8% in 2013-14 from 5.2%. The move is also aimed at staving off downgrades by credit rating agencies.

Related: India's new craving for luxury chocolates

The rating agency Fitch, which has a negative outlook on India's debt rating, said it was encouraged by the country's emphasis on tax increases rather than spending cuts.

Despite the thumbs up from Fitch, tax increases usually lead consumers to pull back, especially during a slowdown.

Government data showed the economy grew by 4.5% in the third quarter from a year earlier, down from 5.3% in the second quarter. It was much weaker than economists had forecast. Fiscal tightening and weaker exports were partly to blame.

"It underlines the difficulty the government will face in reducing the deficit without slowing the expected recovery," noted Aninda Mitra at Capital Economics.

On Wednesday, India forecast growth of between 6.1% and 6.7% in 2013-14.

Related: India's economy grows at slowest rate in decade

Following a slowdown triggered by the global financial crisis in 2008-09, the Indian economy responded strongly to fiscal and monetary stimulus and achieved growth of 8.6% and 9.3% between 2009 and 2011. But last year, growth slowed down to 6.2%, in part because of weaker expansion in agriculture and industry.

Chidambaram said India was planning to raise $1 trillion for infrastructure investment and expected the private sector to provide nearly half that investment.

-- CNNMoney's Mark Thompson contributed to this article

![]()

First Published: February 28, 2013: 10:50 AM ET

Beam stock: A buy or a sell?

Bill Chappell (left) and Ian Shackleton

(Fortune)

The bull: Bill Chappell, Suntrust Robinson Humphrey

"Beam has two factors in its favor. Before spinning Beam off in 2011, Fortune Brands (FBHS)invested to make sure it could work as a standalone company, giving it strong management, improved marketing, and even acquisitions. On top of that, it's in a very attractive industry, with high barriers to entry. Plus bourbon -- Beam's specialty -- is seeing a renaissance worldwide. Beam (BEAM) is in a position to benefit, as it earns almost 50% of its sales from overseas. The company expects 7% to 9% growth in earnings per share in 2013. We think that's conservative, largely because spirits companies are increasing prices again. That will improve margins. Beam, now trading near $62, isn't cheap compared with its peers. But the growth we're seeing justifies this. Our target is $70."

The bear: Ian Shackleton, Nomura Securities

"Clearly there are some positives. It's a good industry, and Beam has some strong brands. But speculation that it could be a buyout target has increased the share price beyond Beam's worth: It's trading at 20.6 times earnings per share for 2014, while the industry average is 17.3 times. We don't expect a bid in the short or medium term. Few potential suitors could afford Beam, which has annual sales of $2.8 billion. Plus, companies seem interested in some brands, like Jim Beam and Maker's Mark, but not the entire portfolio. Finally, despite a rejuvenation of interest in bourbon, Beam has struggled in emerging markets. It touts about 15% of sales there, while Diageo commands 40%. We see a more reasonable price target of $55."

This story is from the March 18, 2013 issue of Fortune. ![]()

First Published: February 28, 2013: 11:00 AM ET

Emerson Electric's David Farr bets on a manufacturing renaissance

Emerson Electric's David Farr succeeded a legendary CEO but is making his own mark.

(Fortune)

Farr, 58, is only the third CEO Emerson (EMR, Fortune 500) has had in the past 59 years, having succeeded the legendary Chuck Knight in 2000. Intense and voluble, Farr recently unloaded some adult language on a room of Wall Street analysts but behaved himself when he talked recently with Fortune's Geoff Colvin about why not everyone should go to college, the difficulty of redirecting a company, Chinese garbage disposers, and much else. Edited excerpts:

Q: U.S. manufacturing is a hot topic. What are the prospects?

A: The U.S. is facing a unique opportunity to have a renaissance of manufacturing. It doesn't mean you're going to see a lot of jobs flying back here, but what you're seeing is a huge level of innovation and technology that will rebuild some of the manufacturing base that has left the country.

What's the basis of the renaissance?

One will be the influx of oil and gas. Most people don't realize that in the manufacturing world, energy is one of our highest costs. If I look at our manufacturing facilities around the world, typically energy is the No. 1 cost by far. So from the oil and gas renaissance you're going to see a lot of investments going in -- very technology- based investments, typically.

For example, Sasol (SSL), a South African oil company, is looking to invest $20 billion in the U.S. because of the gas -- it has unique technologies in oil and converting gas to liquids. So it's working in Louisiana to make two huge facility investments. That is the type of investment that can happen in this country right now that would create a lot of unique value, and that's the type of customer base that I'm involved in. These investments will drive exports, and they will drive higher education and jobs. Most of us in manufacturing have globalized the business, and now what we have left [in the U.S.] are the very high-end technology-based jobs.

Many people seem to have an outmoded view of what a manufacturing job or plant is today.

Yes. I grew up inside manufacturing facilities -- my dad was a plant manager for Corning (GLW, Fortune 500) for many years, and back then you'd see a lot more labor. What you see today is engineering. Facilities are more technically oriented; there's more automation. This country has been going through this revolution since the mid-1980s, since the Japanese came after us. We as manufacturers have learned how to be globally competitive. And we're sitting today the best we've sat in a long, long time.

Can you find those highly skilled technology-apt workers you need?

That is the No. 1 challenge for us right now. We've got a whole thrust in this country of "Everyone goes to college." Wrong -- not everyone should go to college. We need people in a facility who can weld, who can repair things. Technical schools have really dropped off, and we've been funding a lot of technical schools because that is a skill set we need. The No. 1 threat to growth and manufacturing in the U.S. is not only engineering but the technical base to run factories. You and I can't run a factory. You need the technical skills.

You've made some major strategic moves in running Emerson, and you're making more. What's the big-picture thinking behind those changes?

For a company to stay viable and relevant, you have to continuously rebuild. My predecessor ran the company for 26 years. He did it three times. I'm on my second go-round. We're going through businesses that we can continue to invest in and move the company forward, but you have to constantly look at what you have and say, "This car doesn't work anymore. We need to move on."

It is not easy. I went to the board my second year on the job and said I wanted to sell the founding business of Emerson [electric motors]. The board looked at me like I had three heads. But I said the business no longer can generate the growth or returns or cash that we need to make sure we stay competitive and viable. So we found the right buyer, a Japanese company, and moved on.

A large trend that's important to you involves data centers, these vast quiet rooms with no moving parts. Where's the opportunity for Emerson?

You have to manage the power, cooling, and reliability of the data center. And we've built a business over the past 25 years to serve this industry. The trend now is hyperscale-size data centers based on the Googles (GOOG, Fortune 500) and the Facebooks (FB), and the technology there is how to make them more energy efficient and more reliable and try to get as much inside a footprint as possible without using a lot of power and heat. And that's what we do. Simplistically, I want to see energy used, and I want heat generated, because we're going to generate that electricity, and then we're going to cool it.

I would think the outlook for cooling and refrigeration globally must be strong.

It's very strong, especially in emerging markets. In places like China and India over 35% of the food is wasted because it's not properly stored or cooled. So we've developed cooling and refrigeration technologies to help those countries. It's been a huge marketplace for us.

Another Emerson business is making products for homes, which gives you a great interest in the U.S. housing market. Where is it headed?

We're recovering off a very low base. We've been in housing for a long time, making things called garbage disposers. We make 6 million a year in Racine, Wis. We're now working with cities to figure out how to reduce food waste by grinding it and then processing it for energy and fertilizer. Rather than garbage going out into landfills, we're changing the grind, and we're going to send it through a processing plant.

We just made our first investment in China doing the same thing because one of their top five issues is food waste. And by the way, the grinder for China is different from the grinder you have in your house.

Because?

The food's different in China. You have rice, and you have more stringy vegetables. So the grinding mechanism is different. It's a unique technology that the average person would never think about.

You've been very critical of the U.S. business environment. How do you rate it now?

My biggest criticism has been from the standpoint of legislation and bureaucracy that create trouble for us when it comes to investing. From a business perspective, we do not work on month-to-month changes in government. If the government does a deal for 30 days, all that does is cause problems for us in deciding what we're going to do. So we're looking for other places to invest.

We've got to figure out how to cut back regulation so it's not in our way all the time, and also how to have a road map on taxation or any type of structure you want from a government. What are the rules? I want the rules laid out for five, 10, 15, 20 years. I know they have to be altered a little bit, but you've got to have a road map.

I've been very critical because I think government doesn't understand what it takes to invest, and I think we as a nation are sitting at a cusp of once again being a very strong global player. We can beat China on a global basis.

How?

You play to your strengths -- entrepreneurship, education, the natural resources we have. Our people have historically been hard working. We're smart. We want to get an education, and we're very innovative. We can rebuild that entrepreneurship spirit and continue to be one of the global economic players.

At Emerson you succeeded one of the great CEOs of American business, Chuck Knight. What's the most important thing you learned from him?

Two things. One, develop the best people around you. Never compromise with people. Two, do not be afraid of taking on challenges that you would think are far beyond what you could do. Take on that risk. Do it. Chuck threw me into a lot of positions that people would have thought I should have never been in, but I succeeded. He drove us to do things that we never thought we could do, and that's why inside me today, I think I can do anything.

THE LEADERSHIP SERIES Formerly called "C-Suite Strategies," this is the latest interview with a top executive by Fortune senior editor-at-large Geoff Colvin. See video excerpts of this interview at fortune.com/leadership -- plus find Colvin interviews with Charles Schwab, the team of Jeff Immelt (GE) and A.G. Lafley (P&G), former New York City schools chancellor Joel Klein, Pimco's Mohamed El-Erian, Humana CEO Michael McCallister, and many more.

This story is from the March 18, 2013 issue of Fortune. ![]()

First Published: February 28, 2013: 11:02 AM ET

Don't look now, but M&A is back

SolarCity is making solar power pay

(Fortune)

A: Most of the taint is around solar manufacturing. Our business model is totally different. We're an energy company. We install solar systems for free, and we sell the electricity at a lower rate than you can buy it from the utility. So given the option of paying more for dirty power or paying less for clean power, what would you take?

How did you choose the 14-state territory where you operate?

We first look at the functional economics: What is the current cost of electricity? Then we look at how much sun that market gets. And then we look at the state's [tax] incentives.

Sunshine isn't enough?

It helps a lot. As an example, the cost of electricity is relatively cheap in Arizona. But they get an incredible amount of sun. Oregon is a state where the sun's not so great. But Oregon has a strong state incentive and wants to see residents adopt clean energy, so the economics still work.

Home Depot is a big part of your sales process.

Someone might go to Home Depot (HD, Fortune 500)to buy dirt, and they'd speak to one of our solar consultants, who explains, "Hey, you can get a solar system for free and pay less for the electricity."

Do you pay rent?

No. We pay Home Depot per customer we sign up.

In February, you announced a partnership with Honda for a $65 million fund to help its customers and dealerships finance solar. Why?

It's the first time they're promoting a non-Honda product. Honda has a mission to reduce its carbon dioxide footprint and to educate its customers too.

How will tariffs on Chinese solar panels affect your business?

Tariffs have already affected panel pricing from China into the U.S. That's built into the cost. The cost reduction was a larger number than the tariff itself. So if there wasn't a tariff, the price would be even lower.

You went public during a tough time. Investors initially were unreceptive, forcing you to lower your share price. Why didn't you wait altogether?

We decided to take the hit to get out, show the market that this is a different business, with a growth potential that is almost infinite based on the market size. We'll let investors grow with us.

--Connected is an interview series with leaders of innovative companies. For a video, go to fortune.com/connected.

This story is from the March 18, 2013 issue of Fortune. ![]()

First Published: February 28, 2013: 11:11 AM ET

Why Washington can't cut wasteful spending

Trying to secure funding for the infamous "bridge to nowhere" in Alaska was a prime symbol of government waste.

WASHINGTON (CNNMoney)

Almost every year in the last decade, both Presidents Obama and George W. Bush have identified redundant, bloated or useless programs and departments to be cut from the federal budget. And lawmakers have mostly ignored them.

Last year, the president proposed 210 cuts to save $24 billion in a year, which included eliminating a redundant Air Force satellite system and an entire fleet of C-27J cargo airplanes that the Pentagon didn't need.

Similarly, both Presidents Bush and Obama wanted to pull funding for a non-essential agriculture program that made digital versions of public TV broadcasts for a rural audience. The funding still continues.

Indeed, Congress doesn't have a great record on small cuts shown to be wasteful.

More often, they make such spending worse, said Ron Bonjean, a political consultant who worked for both former House Speaker Dennis Hastert and former Senate Majority Leader Trent Lott.

In 2011, for instance, Obama suggested scrapping Voice of America's radio broadcast in China, because studies showed few people were listening. But House Republicans wanted to send the program an additional $14 million to keep it on air.

"The challenge here is that one man's trash is another man's treasure," said Bonjean of Singer Bonjean Strategies. "While some of (the spending) may sound or look ridiculous, there's always a member of Congress defending it."

More recently, one reason why Congress has failed to slash such spending is because it has not passed an official budget in the last four years. Instead, Congress has resorted to passing short-term funding measures, often waiting until the very last minute.

"Right now, we have budget-making by crisis, and it has to be a major crisis, like a debt ceiling or a government shutdown," said Patrick Lester, fiscal policy director for the Center for Effective Government, a watchdog group.

The next short-term budget fix will expire March 27.

Now, allegations are flying from both sides of Congress blaming the other for not finding a better way to trim deficits than the blunt, across the board spending cuts scheduled to take effect Friday.

House Republicans say scrubbing spending is key to stopping the budget cuts. They have passed several proposed budgets over the past few years that drastically slash all kinds of spending but they have failed to clear the Democrat-controlled Senate.

Related: Budget cuts: I'm losing my job next week

In the public eye, wasteful spending is synonymous with the kind of "earmarks" that lawmakers have in the past tucked into the budget to pay for pet projects that benefit their own districts.

The ultimate symbol of pork-barrel spending came to light in 2005 during the Bush administration, when former Republican Sen. Ted Stevens tucked $223 million into the budget for a bridge in Alaska to connect the town of Ketchikan to Gravina Island, population 50. Mounting criticism over the bridge pushed House Republicans to pull the bridge's funding from the budget.

Congress got rid of earmarks in 2011, though most insiders believe that lawmakers will find other ways to spend on pet projects.

In recent years, the White House has launched its own campaign to cut wasteful spending. But without Congress, the president's power is limited to working around the edges, such as cutting duplication within agency budgets.

When contacted, the White House budget office pointed to a 2012 report on its progress cutting wasteful spending, which included shutting down 100 data centers, digital warehouses that can waste energy, and selling $3 billion worth of unused federal real estate.

But Republican Sen. Tom Coburn wants more. He sent a letter to the White House on Tuesday, saying officials can stop federal furloughs by getting rid of duplicate jobs at some 1,362 programs that were identified by the U.S. Government Accountability Office.

"During a time of budget cuts, it is irresponsible to pay two or more people to do the same job," wrote Coburn, an Oklahoma Republican in the letter. ![]()

First Published: February 28, 2013: 11:28 AM ET

Turkish Airlines goes global

Written By limadu on Kamis, 21 Februari 2013 | 23.53

A fleet of Turkish Airlines jets, photographed in Istanbul

(Fortune)

Bold, brave moves are fast becoming the hallmark of Turkish Airlines, one of the world's fastest-growing carriers. At a time when many airlines are struggling to stay aloft, Turkish Air is expanding aggressively. It now flies to 98 countries -- that's more than any other airline -- and it is quickly ticking off all the boxes needed to become a brand-name global carrier.

Since 2003, when Turkey deregulated its airline industry, Turkish Airlines has nearly quadrupled its passengers, tripled its aircraft, and doubled its number of destination cities. Its fleet is half the average age (6½ years) of its European competitors. Flatbed business seats and "star chefs" have earned it Skytrax's title of Best European Airline two years in a row. Some analysts have begun to compare Turkish Airlines to Gulf carriers Emirates, Qatar Airways, and Abu Dhabi-based Etihad, which pride themselves on customer service. In 2010 it unveiled a slick global marketing campaign featuring stars such as Kobe Bryant and Barcelona footballer Lionel Messi. The airline's investments appear to be paying off: In the first nine months of 2012, Turkish Airlines' profit climbed 665%, to about $482 million, on sales of $6.2 billion.

MORE: The mystery company importing Americana to the Mideast

The company certainly benefits from a growing domestic economy and a rise in tourism to Turkey: Some 35 million leisure travelers visit the country annually, up from 14 million in 2003. Now CEO Temel Kotil is pushing the airline to capitalize on its advantageous geography (Istanbul is a three- to four-hour flight from many cities in Europe, Asia, and Africa) to turn the airline into a hub carrier for international travel. "We're Asia and Europe at the same time," Kotil says.

Last year the airline added routes to 22 cities, including Edinburgh, the Maldives, and, yes, Mogadishu. Dozens more destinations are slated for 2013, including Houston's George Bush International Airport. In all, Turkish Airlines has increased its network of routes by 43% since 2009.

Kotil is also capitalizing on the woes of European airlines. Hungary's flagship carrier, Malev, and Spain's Spanair have gone out of business, while SAS and Air France-KLM, among others, have cut flights.

Turkish Airlines has managed to keep operating costs relatively low with its newer, more fuel-efficient planes and the country's cheap workforce. Analysts say the airline has been helped along by the government's support, particularly in terms of infrastructure investment -- in January, Turkey opened bidding for a construction contract to build a third airport in Istanbul, which, according to media reports, will be one of the largest in the world.

MORE: Southwest's Herb Kelleher - still crazy after all these years

But Kotil acknowledges the airline's steep and speedy ascent is not without risks -- like maintaining the same quality training, management, and service across the enterprise. "We're growing everywhere." Indeed, Turkish Airlines is widely rumored to be in talks with Lufthansa about a joint venture or other alliance.

Kotil declines to comment on any deals; he says his goal is for Turkish Airlines to fly 2,000 flights a day, double its current levels. (By comparison, United Airlines operates 5,000 flights a day.) And while Turkish Airlines has long ceased to be a government-controlled entity (it was privatized in 2006; the government still owns a 49% stake), Kotil sees its expansion as a point of pride for his country. "Istanbul has been one of the major cities in Europe for centuries," he says. "In the last century it lost momentum; in the 21st it's coming back. Turkey is a part of everything." Including, if Kotil's bets pay off, the global airline industry.

This story is from the February 25, 2013 issue of Fortune. ![]()

First Published: February 21, 2013: 7:32 AM ET

Nike suspends contract with Pistorius

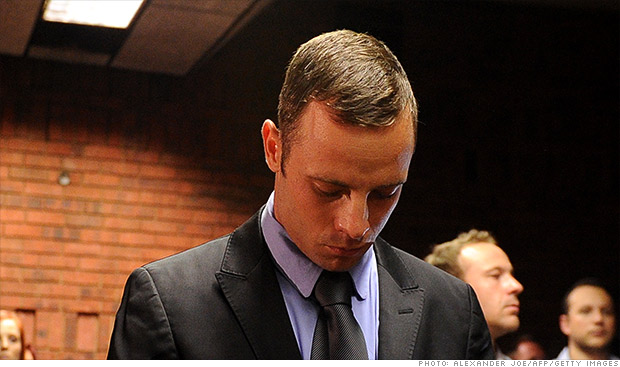

The Olympic athlete has been charged with murdering his girlfriend.

NEW YORK (CNNMoney)

"Nike has suspended its contract with Oscar Pistorius. We believe Oscar Pistorius should be afforded due process and we will continue to monitor the situation closely," Nike said in a statement posted on its website late Wednesday.

Pistorius competed in the 2012 Olympics despite having both his legs amputated as a child. He is known as the "Blade Runner" because he walks and runs on carbon fiber prosthetic legs shaped like blades.

He has maintained his innocence since the Feb. 14 shooting that killed Reeva Steenkamp, his model girlfriend, saying he mistook her for an intruder. But he was charged with murder the day after the shooting.

Pistorius had been getting about $2 million annually in endorsement deals, according to published reports. Eyewear maker Oakley, his other major sponsor, has already suspended its deal with him, according to reports.

Nike's campaign with Pistorius, which started soon after his 2012 Olympic appearance, is particularly bad public relations for the company as it refers to him as "the bullet in the chamber."

He first appeared in a 2008 Nike commercial, a spot that also included cyclist Lance Armstrong. Nike ended ties with Armstrong after evidence emerged that he had used performance-enhancing drugs to win seven Tour de France titles.

But Nike has been slow to cut ties with disgraced athletes. The day of the shooting it issued a statement extending its sympathy but saying it wouldn't comment because it was a police matter. It initially stood by Armstrong, even as the anti-doping authorities accused him of cheating and moved to strip him of his titles.

It also kept its endorsement deal with Kobe Bryant while he faced sexual assault charges. It was the first major company to strike a sponsorship deal with Michael Vick after the football star got out of prison for staging dog fights. And it has stood by golfer Tiger Woods during his sexual infidelity scandal that chased away other major sponsors including PepsiCo's (PEP, Fortune 500) Gatorade, General Motors (GM, Fortune 500) , Procter & Gamble's (PG, Fortune 500) Gillette razors and AT&T (T, Fortune 500).

Nike (NKE, Fortune 500) spends far more than any other company on sponsorship deals. Its most recent filings with the Securities and Exchange Commission show it is committed to $3.8 billion in future endorsement deals. ![]()

First Published: February 21, 2013: 7:48 AM ET

Jobless claims rise

Job seekers at a recent New York City jobs fair.

NEW YORK (CNNMoney)

The Labor Department report showed 362,000 Americans filed for jobless benefits in the latest week, up from 342,00 the previous week, when claims may have been limited by snow storms in several states.

The average number of people seeking help over the past four weeks totaled 360,750, up 8,000 from the four-week average the previous week. Economists prefer to look at the four-week average to smooth out the impact of short-term blips that can be caused by weather and other special events.

Related: Unemployed would lose benefits if federal budget cuts go through

Overall, average claims are down from where they were a year ago, but the improvement has been very gradual. They've largely been hovering in the 350,000 to 400,000 range -- a level that seems to be consistent with the U.S. economy, which has added about 180,000 jobs each month. But that's barely enough to keep up with population growth and not enough to make significant improvement in reducing the unemployment rate.

In addition to counting first-time claims, the Labor Department also tracks people who have filed for their second week or more of benefits. The latest data show 3.1 million people filed continuing claims during the week ended February 9, an 11,000 increase from a week earlier, but down nearly 8% from those receiving longer-term help a year ago. ![]()

First Published: February 21, 2013: 8:49 AM ET

Inflation remains subdued in January

Inflation was tame in January, but prices are likely to rise in coming months, largely driven by higher gas prices.

NEW YORK (CNNMoney)

The Consumer Price Index, the government's key measure of inflation, showed prices were unchanged for the second month in a row in January, according to the Bureau of Labor Statistics.

Compared to a year earlier, though, prices were up 1.6%.

With inflation running under 2% a year, it's considered subdued and not a threat to the broader economy.

"The bottom line is that there are few signs that inflation is becoming a problem," said Paul Dales, senior U.S. economist with Capital Economics.

That being said, economists expect to see prices rise slightly in coming months, driven largely by higher gas prices. The CPI report showed gasoline prices fell in January, once seasonal adjustments were factored in, but economists are expecting to see a sizeable increase in the February figures.

Check gas prices in your state

Gas prices have been rising for 36 straight days, according to AAA. At $3.778 on Thursday, the price for a gallon of unleaded gas is 49 cents, or about 15% higher than it was on January 17, when prices started rising.

Stripping out energy and food, which are both volatile categories, shows prices are rising in other categories, although not by much. That measure, called core CPI, rose 0.3% in January alone, and is up 1.9% compared to a year earlier. ![]()

First Published: February 21, 2013: 8:42 AM ET

Wal-Mart warns of soft start to year

Wal-Mart had a strong holiday season, but payroll taxes and higher gas prices have weighed on the company in the new year.

NEW YORK (CNNMoney)

"In the last couple of weeks of the quarter, we began to see an impact from the increase in payroll taxes and the delay in the income tax refunds," said Wal-Mart (WMT, Fortune 500) U.S. CEO Bill Simon.

February sales at the nation's largest retailer were also slower than planned, Simon added.

The delay in tax refunds has caused people to pull back discretionary spending on items like a new television before the Super Bowl, he said.

Hit with smaller paychecks, customers are starting to make adjustments in what they buy. However, Simon hasn't noticed a measurable trade down or change in traffic patterns yet.

"Customers know about it and are adjusting," he said. "We don't have a clear vision of how they'll continue to behave throughout the year."

Related: Wal-Mart's suppliers could be hit by payroll tax and gas prices

Another sign of the pullback: the retailer noticed a shift in the way small businesses are stocking up at its warehouse club division Sam's Club.

Rosalind Brewer, CEO of Sam's Club, said that businesses were "more deliberate in their spending."

According to Wal-Mart's chief financial officer Charles Holley, Wal-Mart has started adjusting the sizes of products it sells and the assortment it displays on its shelves. Executives wouldn't elaborate.

"We are prepared for when customers have the paycheck in their hands and when they don't," he said.

Speculation about a slowdown started buzzing last week, when leaked emails from Wal-Mart executives who called the month a "total disaster" surfaced.

As the country's largest retailer, Wal-Mart is viewed as a barometer for consumer sentiment.

Investors will be watching closely to see if the payroll tax hike will hit spending at other retailers as well. So far, many retailers have reported healthy sales in January, a sign that not all consumers may be worried about higher taxes and a still stagnant economy just yet.

But the sluggish start to the year at Wal-Mart comes after a decent fourth quarter, which was bolstered by steady sales during the holiday season.

Wal-Mart said earnings rose 7.9% from a year ago to $5.6 billion, or $1.67 a share. That beat Wall Street's estimates of a profit of $1.57 a share, according to a survey of analysts by Thomson Reuters.

Revenue came in just slightly below expectations though. The company reported a 3.9% increase in total revenue to $127.9 billion. Analysts were forecasting $128 billion.

Wal-Mart also announced it would increase its annual dividend by $0.29 to $1.88 per share for fiscal 2014, an 18% increase over last year.

Simon said that the company did well on Black Friday weekend and throughout the holiday season.

He said that Wal-Mart's strategy of hour-long specials on Thanksgiving, where it offered low prices on items like HDTVs and Apple's (AAPL, Fortune 500) iPad 2 to anyone who visited the store on Thursday evening, paid off. The store's layaway plan, which let customers hold an item for a period of time while they made incremental payments to cover its costs, also did well.

Sales of toys and food were particularly strong.

"Our performance during the key holidays was solid," Simon said.

The busy flu season also drove up sales in its health and wellness division.

The company also addressed the investigation into allegations of bribery of foreign officials at Wal-Mart's Mexico operations.

The charges stem from allegations that Eduardo Castro-Wright, the former CEO of Wal-Mart's Mexican division and former head of Wal-Mart U.S., orchestrated $24 million worth of bribes in Mexico to secure construction permits. The claims were reported in a New York Times article in April.

The retailer said in November that it was broadening its investigation into bribery allegations to include India, China and Brazil, and that the company has spent more than $35 million to ensure it complies with the U.S. law.

"We've spent thousands of hours and millions of dollars with compliance experts on anti-corruption support and training," Wal-Mart CEO Mike Duke said on Thursday. "We will have a world-class compliance organization."

Shares of the company were up 95 cents to $70.14 at the open of trading. ![]()

First Published: February 21, 2013: 7:55 AM ET

Biggest problems with the budget cuts

The March 1 budget cuts will affect Americans in myriad ways, like at airport check-in lines.

NEW YORK (CNNMoney)

The cuts are bad policy.

They're indiscriminate: They give spending cuts a bad name. The law governing them requires that they be applied in a uniform way across the board.

In other words, the meat of the federal government will be cut along with the fat, and by the same percentages in many instances. So needed projects and investments will be cut in equal measure with bloated projects that are duplicative. And people doing good work will lose jobs or pay right alongside people who do shoddy work.

"There's no business in the country that makes its cuts across the board. You ... try to surgically cut those things that have the least adverse effect on productivity," Erskine Bowles, who co-chaired President Obama's fiscal commission, said at a Politico breakfast this week.

(Related: Jobless benefits would be hit)

They cut from the smallest part of the budget: Most of the cuts will come from discretionary spending -- defense and nondefense -- which together account for just over a third of all spending.

What's more, discretionary spending has already been subject to spending curbs. So much so that even without the March 1 cuts, discretionary spending is on track to fall to a 50-year low as a share of the economy by the end of the decade.

That doesn't mean more can't be cut from discretionary, but the magnitude, the manner and the timing of the March 1 cuts are ill-advised.

They don't really address the debt: The irony is that while the spending cuts will reduce deficits, they won't do anything to keep the country's debt from growing at an unsustainable rate.

That's because the real drivers of the country's debt -- in particular the entitlement programs Medicare and Social Security -- are largely exempt from the March 1 cuts.

The big entitlements take up the largest single part of the budget now -- about 43% of all spending -- and will swallow up ever larger chunks over the next few decades because of the aging of the population and the still-fast-growing cost of health care.

Indeed, spending on entitlements and interest on the debt, barring any changes, will grow faster than the economy indefinitely.

"They keep slashing the one-third of the budget that has already been seriously squeezed by the [2011 Budget Control Act's] spending caps, while not taking any significant actions on entitlement spending or tax expenditures," said budget expert Charles Konigsberg.

So given all the strikes against it, why is the so-called sequester still in place? Because lawmakers can't get it together to replace it with something better.

They might get around to it by the end of March -- or March 27 to be precise. That's when the current government funding bill, known as a continuing resolution, expires. If Congress doesn't pass a new one, the government will shut down on March 28.

That's a rather unattractive prospect for both parties.

So it's possible the threat of a government shutdown, coupled with public anger over the cuts -- which will affect Americans in myriad ways -- might just compel lawmakers to undo at least some of the March 1 budget cuts before they do too much damage. ![]()

First Published: February 21, 2013: 9:45 AM ET

How to fence $50 million in stolen diamonds

NEW YORK (CNNMoney)

That was one of the questions raised by this week's daring diamond heist at Brussels Airport in Belgium.

Experts say the answer starts with the diamonds themselves. Are they uncut or polished?

Uncut diamonds are tougher to trace. Thieves will often rush to get them cut after they're stolen, changing their characteristics drastically and therefore making them harder to track down.

Polished diamonds, on the other hand, are more likely to be laser inscribed with a name or number on the stone, almost like a license plate, helping authorities readily identify them.

(Related: Notable diamond heists)

And the diamond industry is on high alert.

Thieves who get away with a big haul have one of two options: They can "bury" them -- hiding them for a few months or years before selling them. Or they can "fence" them immediately, selling them to illegal wholesalers they've set up beforehand.

Stolen diamonds are often sold at a fraction of their value to unscrupulous buyers who turn around and sell them at a hefty profit to unknowing retailers.

Related video: Diamonds for investment, love and bling ![]()

First Published: February 21, 2013: 10:30 AM ET

Housing rebound continues with strong sales and price gains

NEW YORK (CNNMoney)

The National Association of Realtors reported that previously-owned homes sold at an annual pace of 4.92 million homes, 9% higher than this time last year.

Home prices were up 12.3%, taking the median to $173,600. That marked the biggest percentage gain since January 2005.

The price rise is being driven by tight inventories, increased demand from buyers, and a drop in sales of distressed homes, such as those in foreclosure.

Related: Playing the housing rebound

There were 1.74 million previously-owned homes on the market , equal to only about a four-month supply at current sales levels. It's the tightest inventory of homes on the market since 1999.

And distressed home sales made up only 23% of January sales, compared to 35% of sales a year ago.

The housing market has been helped by a number of factors in recent months, including near record low mortgage rates and a drop in the nation's unemployment rate.

Home construction has also been improving -- builders filed for the greatest number of building permits in more than four years in January.

Even if you're not trying to sell your home, the improvement is good news: It is an important driver of overall economic growth. ![]()

First Published: February 21, 2013: 10:34 AM ET

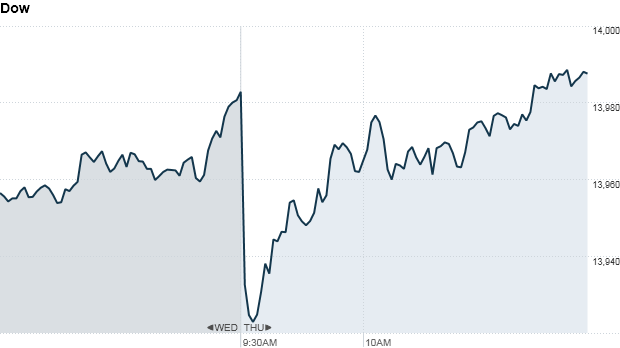

Stocks in red after downbeat economic data

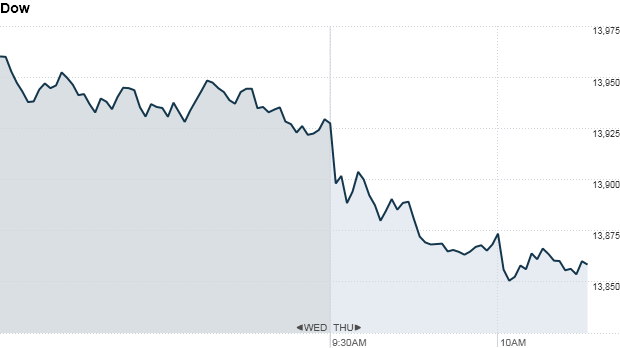

Cick the chart for more stock market data.

NEW YORK (CNNMoney)

The Dow Jones industrial average declined 0.3%, while the S&P 500 and Nasdaq fell 0.4%.

Wednesday and Thursday's combined losses mark the biggest two-day drop in U.S. stocks this year. Stocks are still up between 4% and 6% in 2013, but the S&P 500 is now headed for its first weekly loss of the year, down more than 1% over the past three days. The Dow is headed for its third consecutive weekly decline, while the Nasdaq is poised for its second straight weekly drop.

Investors were disappointed Thursday after a survey of purchasing managers showed Europe's downturn worsened in February. The index has been stuck below 50 for a year, indicating the services sector has been contracting. European markets fell sharply following the data.

Economic news out of the United States was also downbeat. The Philadelphia branch of the Federal Reserve reported a surprise decline in its monthly business outlook survey. The reading fell to -12.5 in January from -5.8 in December. Economists were expecting the index to rise to 1.5.

Initial jobless claims rose to 362,000 last week, coming in higher than economists were expecting.

The National Association of Realtors reported that existing home sales rose 0.4% in January. But the number of homes for sale dropped to the lowest level in more than 13 years, according to the National Association of Realtors.

The Consumer Price Index was unchanged month-over-month in January, and up 1.6% from a year ago. Core CPI, which strips the price of food and energy, increased 0.3% month-over-month in January, and 1.9% from a year earlier.

On the corporate front, Wal-Mart (WMT, Fortune 500) reported earnings that beat forecasts but said sales had softened during the quarter. The retailer also hiked its annual dividend by 18%.

Related: Crunched consumers are cutting back

Tesla (TSLA) shares sank 10% after the electric-car maker posted a wider-than-expected loss for the fourth quarter.

Hewlett-Packard (HPQ, Fortune 500) is up after the closing bell.

Shares of Constellation Brands (STZ) jumped after Anheuser-Busch InBev (BUD)and Grupo Modelo SAB said they are in talks with the Justice Department to try and resolve an antitrust lawsuit challenging their planned merger. Last week, AB InBev agreed to sell Constellation its rights to distribute Modelo in the United States as well its brewery in Piedras Negras, Mexico, in an effort to rescue the deal.

Apple (AAPL, Fortune 500) shares fell 0.8% after Foxconn (FXCNF) said it is slowing its hiring of workers at factories in China. The Taiwanese company makes about 40% of the world's consumer electronics gadgets, including products and parts for Apple, Intel (INTC, Fortune 500)and Cisco (CSCO, Fortune 500).

Fear & Greed Index still showing extreme greed

Asian markets ended weaker, also following the U.S. lead. The Shanghai Composite lost 3.0%, the Nikkei fell 1.4% and the Hang Seng declined 1.7%.

The dollar rose against the euro but was weaker versus the pound and the Japanese yen.

Oil and gold prices declined.

The price on the 10-year Treasury rose, pushing the yield down to 1.98% from 2.02% late Wednesday. ![]()

First Published: February 21, 2013: 9:49 AM ET

Foxconn slows new hiring in China factories

More workers than expected returned to Foxconn factories after Chinese new year.

LONDON (CNNMoney)

Companies in China that rely heavily on migrant workers often plan on a number choosing to remain in their home villages after the annual mass migration. This year, more workers have come back to their jobs, according to Foxconn.

"Due to an unprecedented rate of return of employees following the Chinese New Year holiday compared to years past, our company has decided to temporarily slow down our recruitment process," Foxconn (FXCNF)said in a statement Thursday.

The Taiwanese company makes about 40% of the world's consumer electronics gadgets, including products and parts for Apple (AAPL, Fortune 500), Intel (INTC, Fortune 500), Cisco (CSCO, Fortune 500) and others.

Foxconn denied a report in the Financial Times that it had imposed a hiring freeze as it scaled back production of the iPhone 5.

"This action is not related to any single customer and any speculation to the contrary is false and inaccurate," it said.

Related: Apple may be to blame for hiring freeze after all

Lunar New Year is China's biggest holiday. Work stops, factories close and millions of workers pile onto overcrowded trains and buses to leave the cities and return to their families.

Foxconn's factories have been troubled by strikes, violent protests and a series of suicides in recent years linked to poor working conditions.

But earlier this month, under pressure from Apple, the company said it would give employees more union rights, including the chance to vote for representatives free from management influence and secret ballots in elections for top officials.

--CNNMoney's Charles Riley contributed to this report. ![]()

First Published: February 21, 2013: 7:23 AM ET

SAC Capital's day of reckoning

Written By limadu on Kamis, 14 Februari 2013 | 23.53

SAC Capital is run by billionaire founder Steven A. Cohen.

NEW YORK (CNNMoney)

Last month, SAC said it expected $1 billion to be pulled out of the $14 billion fund, according to an investor who took part in a call with the fund. The fund had roughly $6 billion of outside capital as of Dec. 31.

Hedge funds generally allow investors to file for so-called redemptions, or withdrawals midway through each quarter.

The Securities and Exchange Commission has been circling SAC for several years, and last November, the agency formally told the fund that it's getting closer to taking action against it. Several of SAC's former employees have already been charged in the SEC's $276 million insider trading case, including former portfolio manager Mathew Martoma.

A spokesperson for SAC declined to comment on the size of redemptions, but said they shouldn't have a "significant impact on our funds."

Related: SEC closer to taking action against SAC Capital

For SAC, that's more true than for most hedge funds because roughly $8 billion of the $14 billion that SAC manages is from its employees. And the bulk of that $8 billion comes from billionaire founder Steven A. Cohen.

So even if all SAC's investors wanted to run for the hills, the fund wouldn't be put out of business.

Outside investors also must wait a year to get all their money back since SAC only allows investors to take 25% of their capital out of the fund each quarter.

Still, many are wary of being tainted by their association with SAC if the fund gets charged in the insider trading case.

Last month, Citigroup (C, Fortune 500) announced that it planned to jump ship, taking $187 million of client funds out of SAC.

"This decision follows Citi Private Bank standard procedures. It should not be construed as a statement on the merits of any outstanding legal proceedings or potential regulatory action relating to the activities of Mathew Martoma, former employee of SAC Capital," the bank said in a statement at the time.

The bank also said it would be willing to reinvest, if the investigation is "resolved favorably" for Martoma and SAC.

Another key investor has not decided yet. Morgan Stanley's Premium Partners Fund, a so-called fund of funds that manages $1 billion, has $180 million tied up with SAC, according to an investor in the fund. Morgan Stanley declined to comment.

Related: Stocks You Love

Morgan Stanley (MS, Fortune 500) has a bigger incentive than Citigroup to stay with SAC. It's one of five so-called prime brokers that provide SAC with lucrative support services.

None of SAC's other prime brokers -- Barclays (BCS), JPMorgan Chase (JPM, Fortune 500), Goldman Sachs (GS, Fortune 500) and Credit Suisse (CS) -- have investments in SAC.

Other big investors that haven't made their plans known yet: Magnitude, a $3 billion fund of funds with roughly $100 million in SAC, and Blackstone (BX), which Reuters says has $550 million invested in SAC.

Both firms declined to comment.

SAC investors have been richly rewarded over the years, with the fund generating annualized returns of more than 25%, since it was founded in 1992. In 2012, SAC logged gains of 13%, according to a source familiar with the fund's performance.

SAC has not spoken directly to its investors since a call in early January. The fund does not have another one scheduled yet, but investors expect to hear from the fund in the next few weeks. ![]()

First Published: February 14, 2013: 5:25 AM ET

Housing: Play the rebound

With the clouds lifting over home sales, real estate stocks are up sharply.

(Money Magazine)

Anticipating the real estate recovery that surfaced in the fall -- home prices in October were up 6.3% from a year earlier, and new-home construction reached a four-year high -- housing-related stocks led the market in 2012.

Homebuilders (returning 77% through early December), the lumber industry (74%), and home-improvement stores (55%) were the top-performing industries in 2012, according to Morningstar. And the Dow Jones U.S. Home Construction ETF traded in December at a lofty 27 times projected earnings -- nearly double the figure for the S&P 500.

These numbers may make a housing investment look expensive, but it's not too late for you to profit from the revival. The 2012 surge in stock prices was merely a snap back from the worst real estate correction on record, says Michael Magiera, manager of real estate analysis for investment firm Manning & Napier. "Keep that performance in the context of the long cyclical recovery we're going to have," he says.

Related: Million-dollar foreclosures

Of course, various factors could delay progress: elimination of the mortgage interest tax deduction, for example, or an unexpected surge in foreclosures. Still, economists predict a continued upswing.

Moody's housing economist Celia Chen, for one, forecasts above-average growth in construction, prices, and home sales through 2014. "After that," she says, "growth will still be healthy."

That's good news for the slice of your portfolio invested in real estate.

Over the past 20 years, home-related stocks have roughly tracked new construction, itself perhaps the best indicator of the housing market's health. Plus, growth over a cycle can justify the high price/earnings ratios that housing stocks might have initially; future earnings and price appreciation can make those formerly costly-looking stocks seem cheap in hindsight.

Related: Housing to drive economic growth

To maximize your profit, though, you have to look beyond what real estate fund managers judge to be the most expensive parts of the industry: homebuilders and real estate investment trusts that own apartment buildings.

So here are three creative strategies for investing in the boom, along with stock and fund picks for each.

STRATEGY NO.1: Buy the suppliers, not the homebuilders

The numbers support more growth in the housing market. October's annualized figure of 894,000 housing starts -- up 42% from a year earlier -- was still well below the industry's 50-year average of 1.5 million. Existing-home prices will rise 3.3% a year through 2017, forecasts Fiserv Case-Shiller.

"All signs are flashing green," says Jeff Kolitch, manager of the Baron Real Estate Fund.

Problem is, the most obvious beneficiaries of this trend -- homebuilders -- are the costliest stocks in this arena, say Kolitch and other fund managers. "The risk-reward proposition," he says, "is more interesting elsewhere."

One such area: companies selling to homebuilders. The suppliers may have similarly high P/Es, but their prospects for earnings growth are better, partly because their profits come as a delayed reaction to homebuilder activity.

The picks: The division of Weyerhaeuser Co. (WY, Fortune 500) supplying lumber and plywood board to builders -- a money loser in the bust -- has begun to drive earnings, thanks to the minimal investment needed to boost production.

The company's profits, up 48% in 2012, are forecast by analysts to jump 88% in 2013. (Weyerhaeuser converted to a real estate investment trust in 2010, giving it favorable tax treatment in return for paying out most of its earnings as a dividend, now 2.5%.) While the company's 30 P/E is high, a return to 2004 earnings levels -- not a stretch -- would translate into a P/E of only 12, says Ryan Dobratz, co-manager of Third Avenue Real Estate Value, where Weyerhaeuser is a top 10 holding.

Related: $214,000 real estate bet a big risk for couple

A broader way to play the growing demand for timber is via a low-cost exchange-traded fund: iShares S&P Global Timber & Forestry Index (WOOD), which has Weyerhaeuser, Rayonier, and Plum Creek Timber as its top holdings. The average-size home uses about $25,000 worth of lumber, according to the National Association of Home Builders, and construction activity powers the ETF's performance. In December, the fund was up 19% for the year.

STRATEGY NO. 2: Get in on the renovation resurgence

Each percentage point of appreciation in housing prices translates to an additional $190 billion in home equity -- or about $2,500 per household -- says the National Association of Realtors. That uptick makes owners feel more confident about spending money to fix up their houses.

U.S. remodeling spending, which by July 2010 had fallen 37% from its 2007 peak, is on the rise again, up 12% year over year in September. The NAHB predicts a 2013 rise of 3.4%.

Companies tied to renovation didn't go unnoticed in 2012; like the high-performing home-improvement retailers, furniture companies racked up big returns -- 29% through early December. Still, many renovation stocks are expected to grow earnings at double the rate of the average large stock.

The picks: Lowe's (LOW, Fortune 500), operator of 1,745 home-improvement stores around the country, is one of the biggest beneficiaries of this upsurge in activity, says Dobratz; recently reported sales to professional contractors were particularly strong.

The company does more business than larger rival Home Depot (HD, Fortune 500) in big-ticket items like cabinets and appliances, which are snapping back in the recovery.

While its P/E ratio of 20.2, based on expected earnings, was higher than the Standard & Poor's 500's 14 in December, earnings at Lowe's are expected to grow faster -- 20% this year, compared with 11% for the S&P. MONEY recommended Home Depot in October, but Dobratz and other managers say Lowe's, which had surprisingly good third-quarter results, is the better choice.

Or you can buy a basket of home-improvement stocks via S&P Homebuilders ETF (XHB). Don't be fooled by the name: The ETF has 45% of its assets in home furnishings and other remodeling-related companies (and only 25% in homebuilders). Lowe's is its top holding; Whirlpool, Home Depot, and Pier 1 Imports are among its top 10.

STRATEGY NO. 3: Profit from people on the move again

Underwater mortgages and low-ball prices of distressed properties froze home sales after the housing bubble burst; sales of existing homes in mid-2010 bottomed out at the annualized rate of 3.4 million a year. That's changing: Sales as of October were up to 4.8 million a year, reports the National Association of Realtors, which forecasts 5.1 million sales in 2013.

Driving the sales, along with low mortgage rates, are rising prices.

Related: 10 great foreclosure deals

Longtime owners who were reluctant to match fire-sale foreclosure deals have been lured off the sidelines. And fewer shorter-term owners are stuck where they live, owing more on their mortgages than their homes are worth. Data firm CoreLogic says 1.3 million homeowners exited underwater territory as of June, and another 5% price increase would lift 2 million more borrowers above the waterline.

The picks: Roughly half of all self-storage transactions are tied to relocations, according to the National Self-Storage Association. CubeSmart (CUBE) is one of the best values in the sector, says Magiera of Manning & Napier. It trades at a lower P/E than larger rivals and has better prospects as it swaps out facilities in low-growth areas for regions with more potential. A recent dividend hike boosted the REIT's yield to 3.2%.

A fresh coat of paint is a top item on the to-do list both for sellers preparing to list their homes and for recent buyers. Year-over-year growth in paint sales at Sherwin-Williams (SHW, Fortune 500) in the first half of 2012 was the highest since 2005, and the company's cost of raw materials is falling. The stock, a top holding of veteran real estate manager Ken Heebner of CGM Funds, trades at a 30% discount to the S&P 500 when weighing its P/E against its projected earnings growth.

As home sales pick up, another demographic trend comes into play: the aging of America. Fourteen percent of buyers over 50 bought senior housing in 2012, says the NAR, up from 10% in 2010. And the pool of potential buyers -- purchasers' median age is currently 64 -- is expanding: The 65-and-older population will rise from 40 million in 2010 to 72 million in 2030.

Two standout senior housing companies, says the Baron Fund's Kolitch, are Brookdale Senior Living (BKD), which owns 565 properties in 35 states, and Emeritus (ESC), which focuses on assisted living and Alzheimer's services. The firms, which are top holdings in his fund, trade for what Kolitch estimates to be 30% less than their private-market value -- a wide discount compared to the REITs they resemble.

Or you could simply buy Baron Real Estate (BREFX) itself, which is 18% invested in senior housing and 30% overall in housing-related stocks (much of the rest of its holdings are in hotels and gaming stocks). Manager Kolitch joined Baron Funds as a real estate analyst in 2005; the fund has topped its category in two of the three years since its January 2010 launch. ![]()

The picks

You can ride the housing cycle with these stocks, mutual funds, and ETFs.

| Stock (Ticker) | P/E | Earnings growth (%) |

| Weyerhaeuser (WY) | 30.1 | N.A. |

| Lowe's (LOW) | 20.2 | 17.3 |

| CubeSmart (CUBE) | 19.6 | 9.4 |

| Sherwin-Williams (SHW) | 19.0 | 13.0 |

| Brookdale Senior Living (BKD) | 10.3 | 11.5 |

| Emeritus (ESC) | 10.8 | 14.5 |

| Fund (Ticker) | Total return (1 year %) | Total return (3 years %) |

| S&P Global Timber & Forestry ETF (WOOD) | 20.7 | 6.5 |

| S&P Homebuilders ETF (XHB) | 50.7 | 22.8 |

| Baron Real Estate (BREFX) | 39.6 | N.A. |

NOTES: P/E ratios for stocks are based on projected 2013 profit. For CubeSmart, Brookdale, and Emeritus, P/E is price/projected funds from operations, used to measure real estate firms. Earnings growth is annualized three-to five-year projected rate; estimate is not available for Weyerhaeuser. Three-year-return figures are annualized. SOURCES: Bloomberg, Morningstar

First Published: February 14, 2013: 5:53 AM ET

Europe's recession deepens as exports suffer

Hungary's economy shrank 0.9% in the fourth quarter as the eurozone recession deepened.

LONDON (CNNMoney)

Gross domestic product in the 17-nation euro area fell by 0.6% in the fourth quarter, leaving the eurozone economy 0.5% smaller than it was at the start of the year. The region saw a contraction of 0.1% in the third quarter.

The European Central Bank and many economists are predicting a recovery later this year. But overall output is still likely to shrink for a second year running, according to the latest forecast from the International Monetary Fund.

The figures were worse than analysts were expecting and the euro fell to a three-week low against the dollar, although it is still up 5% over the past three months. European stocks were also weaker.

Performances in all four of the region's biggest economies -- Germany, France, Italy and Spain -- deteriorated compared to the third quarter of 2012.

Germany, which accounts for about 30% of eurozone GDP, suffered a contraction of 0.6% and France's economy shrank by 0.3%. Both economies had eked out modest growth in the previous quarter.

"The decline of the gross domestic product at the end of 2012 was mainly due to the comparably weak German foreign trade: in the final quarter of 2012, exports of goods went down much more than imports of goods," the German statistics office said in a statement.

Related: Europe's central banks stand firm on policy

French data showed the region's second biggest economy flat-lining over the year as a whole. France also suffered a sharp fall in exports in the fourth quarter, down 0.6% after growth of 0.7% in the third.

Weaker growth will make it harder for eurozone governments to meet their debt-cutting targets and intensify the debate about the impact of a strong euro on the region's recovery prospects.

With fiscal policy tightening, and the ECB in a holding pattern, exports offer one of the few opportunities for the recession-ravaged region to return to growth. A stronger euro threatens to cancel out some of the hard-won gains in competitiveness brought about by wage cuts in indebted European states.

Related: Europe's next challenge: A strong euro

Many of the 17 eurozone nations are in the middle of austerity programs that are reducing demand, and prompting households and businesses to defer spending and investment.

While policymakers have signaled a willingness to give states more time to bring their budget deficits into line with European Union targets, if the economy continues to deteriorate, there is no sign of a major change in approach.

In the longer term, EU leaders are hoping efforts to remove trade barriers with the U.S. could provide a shot in the arm for growth. Both sides said this week they wanted to move quickly to start formal talks on a trans-Atlantic free trade agreement.

Related: Europe eyes growth windfall from U.S. trade pact

The wider EU economy of 27 states went into reverse in the fourth quarter, shrinking by 0.5%. The U.K. contracted by 0.3% in the fourth quarter of 2012, bringing it to the brink of a third recession in five years.

The Bank of England trimmed its forecasts for U.K. growth in 2013 Wednesday while raising them for inflation. ![]()

First Published: February 14, 2013: 5:45 AM ET

GM earnings hit by European losses

NEW YORK (CNNMoney)

The leading U.S. automaker, which only three years ago needed a federal bailout and bankruptcy reorganization to survive, continued its turnaround by earning $892 billion in the final three months of the year, up 88% from a year earlier.

But 2012 earnings fell 36% from the record profit it posted in 2011. Part of that was due to an accounting gain it posted a year earlier, but a $1 billion larger loss in Europe in 2012 also hurt results.

The company will pay profit-sharing bonuses averaging $6,750 to 49,000 hourly workers at its U.S. plants. That's down slightly from the $7,000 bonuses paid last year. But GM has 1,500 additional workers receiving the bonuses, as increased production led the company to hire workers and add shifts during the year.

Sales at the automaker edged up 1% during the year to $152.3 billion, as the number of vehicles sold climbed 3% to 9.3 million. GM was the leading automaker in China and the United States, the world's two largest markets,once again selling more cars in China than in its home market. But Japanese rival Toyota Motor (TM) was able to regain the global sales title that it had lost to GM in 2011, when the earthquake and tsunami in Japan damaged its output.

Shares of GM (GM, Fortune 500) edged 0.5% lower in premarket trading on the report.

Related: American cars close dependability gap

The company's earnings in North America slipped 3% for the year to just under $7 billion, but that was balanced by a 27% jump in earnings to $2.2 billion in its global unit that included China.

GM was dogged by rising losses on its European operation, at $1.8 billion, a problem that has also dogged rival Ford Motor (F, Fortune 500) and European automakers as well. A worsening recession in Europe cut demand for cars to a 20-year low.

![]()

First Published: February 14, 2013: 8:09 AM ET

Buffett's Berkshire Hathaway buying Heinz

NEW YORK (CNNMoney)

Heinz (HNZ, Fortune 500) shareholders will receive $72.50 a share in cash, a 20% premium over Wednesday's closing price, which was already near Heinz's record high. It will keep Heinz's headquarters in Pittsburgh.

Shares of Heinz shot even higher, to $72.90 a share, in premarket trading on the news. Shares of Berkshire (BRKA, Fortune 500) were not trading pre-market.

Berkshire has investments in a number of high-profile companies, including Deere & Co. (DE, Fortune 500), IBM (IBM, Fortune 500) and Procter & Gamble (PG, Fortune 500). But it also owns a number of companies outright, including fast-food chain Dairy Queen, insurer GEICO and the railroad company Burlington Northern Santa Fe.

![]()

First Published: February 14, 2013: 8:19 AM ET

Stocks: Investors play the waiting game

Click chart for more premarket data.

NEW YORK (CNNMoney)

The number of Americans filing for first-time unemployment insurance fell by 27,000 to 341,000 in the latest week, the Labor Department reported.

In earnings news, General Motors (GM, Fortune 500) released quarterly results that missed expectations, sending shares slightly lower in premarket trading. PepsiCo (PEP, Fortune 500) logged better-than-expected earnings, and shares edged 2% higher.

As of Wednesday, 65% of the companies in the S&P 500 that had reported fourth-quarter earnings came in ahead of analysts' expectations, according to S&P Capital IQ. But the bulk of companies that have issued guidance for the first quarter had a negative outlook.

Related: Fear & Greed Index in extreme greed

U.S. stock futures were lower ahead of the open.

Warren Buffett's Berkshire Hathaway (BRKA, Fortune 500) and 3G Capital have agreed to buy Heinz (HNZ, Fortune 500) for $28 billion. Shares of the ketchup-maker spiked 17%.

US Airways (LCC, Fortune 500) and American Airlines parent AMR (AAMRQ, Fortune 500) officially announced an $11 billion deal to create the world's largest airline. Shares of US Airways rose more than 1%.

Shares of Constellation Brands (STZ) surged in premarket trading after Anheuser-Busch InBev (BUD) agreed to give up key assets in an effort to address antitrust issues related to is proposed takeover of Mexican brewer Grupo Modelo.

Related: M&A making a comeback

Cisco (CSCO, Fortune 500) shares fell 2% in premarket trading, after Cisco CEO John Chambers took a cautious tone with his outlook as the company reported earnings roughly in line with forecasts. Shares of Mondelez (MDLZ) sank 5% after the food producer logged earnings that missed expectations after the close on Wednesday.

U.S. stocks finished mixed Wednesday, struggling to find momentum to push toward record highs.

Related: 10 stocks you love

European markets drifted lower in morning trading, after weaker-than-expected GDP figures from Germany and France pointed to a deepening recession in the eurozone.

Asian markets ended higher. Hong Kong's Hang Seng added 0.9% as traders returned from an extended holiday.

The Nikkei added 0.5% despite data showing Japan's economy has contracted in each of the three most recent quarters. The weak performance is likely to increase the clamor for more aggressive fiscal and monetary stimulus measures.

The Shanghai exchange was closed for the Lunar New Year holiday. ![]()

First Published: February 14, 2013: 4:07 AM ET

Falling jobless claims could be blizzard related

NEW YORK (CNNMoney)

Initial jobless claims fell to 341,000, from an upwardly revised 368,000 the previous week, the Labor Department said Thursday.

It was a welcome surprise, given economists were expecting about 365,000 initial claims.

Jobless claims are seen as a key gauge of the job market, but last week's data could have been distorted by weather. Illinois and Connecticut both submitted estimated data due to the blizzard that hit those areas over the weekend.