NEW YORK (CNNMoney)

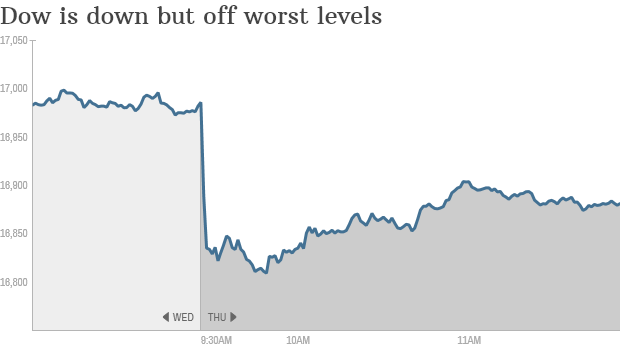

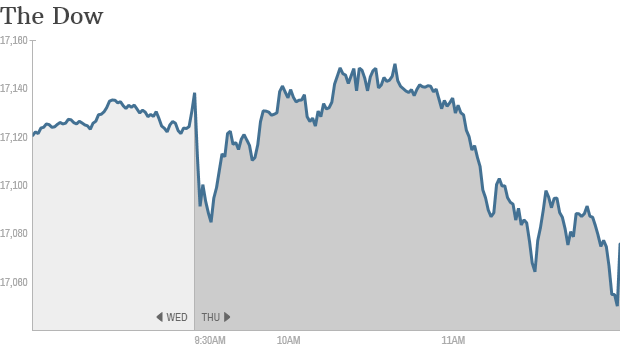

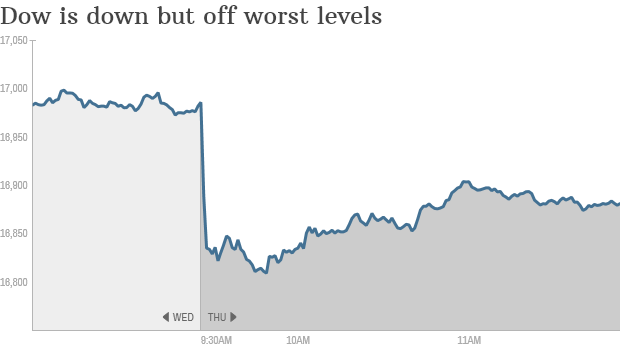

Here's the bad news: U.S. stocks are down sharply Thursday as jitters about a Portuguese bank and ugly economic data raise more doubts about whether Europe is recovering.

Here's the good news: Stocks are bouncing back...a little. The losses aren't as bad as they were earlier in the day.

"This has been a horrible day in Europe by recent standards, with peripheral credit concerns once again rearing their head just as core Europe struggles with a decelerating economy," analysts at Bespoke Investment Group wrote in a note to clients.

Here's what you need to know about today's market sell-off:

1. By the numbers: Investors drove the Dow Jones Industrial Average as much as 180 points lower in morning trading. The index was recently off about 100 points, while the S&P 500 and Nasdaq shed around 0.5% each.

Now the question is: Is this European-fueled slide a blip or indicative of a longer-lasting slump?

"A 5% or 10% correction is a healthy component of any bull market, and that should be considered the worst case scenario," Bespoke analysts said. "It will take a lot more than a soft patch in global economic data and a bad turn for European equities to break the back of this market in the long run."

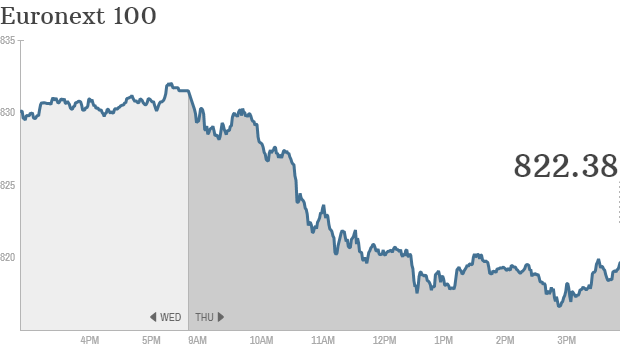

2. Blame Europe! The ugly day began in Europe, where a little known Portuguese bank brought back concerns about the health of the continent's financial system.

Trading of Espirito Santo Financial Group -- the leading shareholder in Portugal's biggest bank -- was suspended. Shares of Banco Espirito Santo (BKESF) plummeted 17% before they were also halted.

The euro banking woes trickled down to U.S. financial firms, with shares of Bank of America (BAC), Morgan Stanley (MS) and JPMorgan Chase (JPM) all down about 1%.

But that's not all that caused European markets to tumble. New reports show industrial production fell sharply in France and Italy, signaling the European economic recovery could be in trouble.

The concerns about Europe mark a sharp reversal from recent months when the continent had been seen as a mild positive to global growth following its sovereign debt crisis.

3. Earnings season is here: After Alcoa (AA) kicked off earnings season earlier this week with a home run, a number of retailers reported mixed results on Thursday.

Family Dollar (FDO) started in the red but was recently trading slightly higher after the struggling retailer reported a drop in same-store sales and profits. The discounter also dimmed its forecast slightly. But Family Dollar has a plan to lure in shoppers: booze. The company said it will follow Wal-Mart (WMT)by selling beer and wine in the coming years.

Related: Is there a 'retail funk'?

Shares of Tractor Supply Co. (TSCO) slumped 2% after the company posted disappointing earnings on Wednesday.

4. Stock movers: Lumber Liquidator, T. Rowe, Zumiez: Investors took a big axe to shares of Lumber Liquidators (LL). The flooring retailer plummeted 22% after disclosing a traffic tumble and projecting profits that would badly miss expectations.

The somber news sparked selling in home improvement stocks like Ethan Allen Interiors (ETH), Lowe's (LOW) and Home Depot (HD).

Potbelly, (PBPB) which went public in October, plummeted 23% after the sandwich chain cut its outlook for the year and said it will try new marketing moves.

"$PBPB Calling a restaurant 'potbelly' in a nation where everyone is trying to lose weight might be a clue?" StockTwits user BlackBerril wrote.

While Family Dollar is stuck in the red, shares of Zumiez (ZUMZ) popped 8% after the company boosted its profit outlook for the rest of the year thanks to soaring June sales.

TRW Automotive Holdings (TRW) raced 7% higher amid M&A buzz. The car safety equipment supplier has received a buyout bid from Germany's ZF Friedrichshafen, Bloomberg News reported.

T. Rowe Price (TROW)was among the worst financial performers after the asset manager was reportedly downgraded by Evercore. The worry is that T. Rowe could be hurt by in the coming months by investors yanking cash from U.S. equity funds.

5. Return of U.S. jobs: Americans received another glimmer of hope about the jobs market on Thursday. The Labor Department said initial claims for jobless benefits fell by 11,000 last week to 304,000. That was slightly better than many on Wall Street expected.

The weekly claims report comes on the heels of the June jobs report, which revealed the U.S. added an impressive 288,000 jobs.

Related: CNNMoney's Tech30

6. International markets overview: While Europe is washed in red, Asian markets ended mixed. Markets in Shanghai and Tokyo closed lower, while Hong Kong's Hang Seng defied the broader trend to finish in positive territory.

Mumbai's Sensex posted early gains on the release of the first national budget from Prime Minister Narendra Modi and its promise of sharply higher growth. But the index turned negative later.

First Published: July 10, 2014: 9:55 AM ET

Sberbank serves more than half the Russian population and has millions of customers abroad.

Sberbank serves more than half the Russian population and has millions of customers abroad.  T-Mobile shares jumped 6% on a report about a buyout bid emerging out of France

T-Mobile shares jumped 6% on a report about a buyout bid emerging out of France  Who would you like to see on a $1 bill?

Who would you like to see on a $1 bill?

FCC chairman Tom Wheeler's got some harsh words for Verizon.

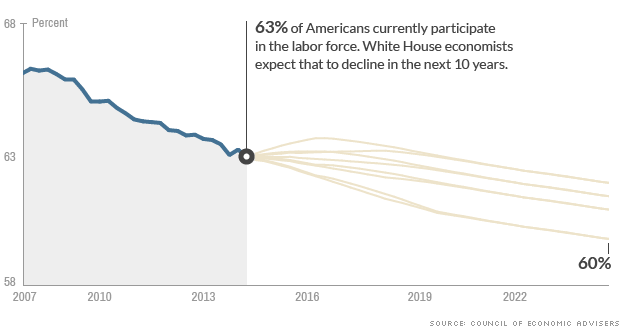

FCC chairman Tom Wheeler's got some harsh words for Verizon.  Uh oh. That arrow's pointing the wrong way.

Uh oh. That arrow's pointing the wrong way.

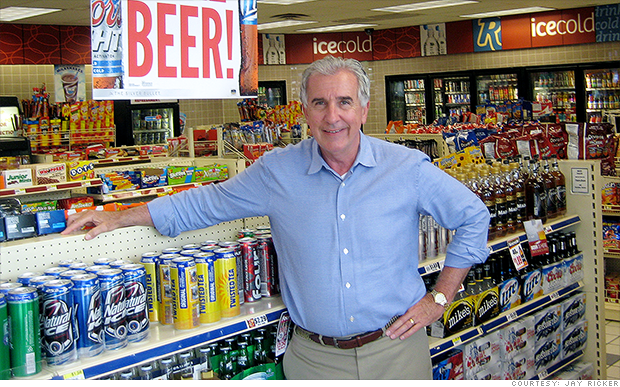

Jay Ricker wants to be able to sell cold beer in his convenience stores, but Indiana law says it has to be warm. He's taking it to court.

Jay Ricker wants to be able to sell cold beer in his convenience stores, but Indiana law says it has to be warm. He's taking it to court.  Fiat shares jumped after a German magazine reported Volkswagen is considering a takeover of the automaker - a claim Fiat denied.

Fiat shares jumped after a German magazine reported Volkswagen is considering a takeover of the automaker - a claim Fiat denied.  The Internet is full of bugs, and Google just launched a superhero team to kill 'em all.

The Internet is full of bugs, and Google just launched a superhero team to kill 'em all.  These caviar tacos grace the menu of 'Rose.Rabbit.Lie.,' a restaurant inside The Cosmopolitan Las Vegas.

These caviar tacos grace the menu of 'Rose.Rabbit.Lie.,' a restaurant inside The Cosmopolitan Las Vegas.  Caviar is served in various amounts. A kilo at 'Rose. Rabbit. Lie.' costs as much as $5,054.

Caviar is served in various amounts. A kilo at 'Rose. Rabbit. Lie.' costs as much as $5,054.

Russian markets have been on a wild ride this year as investors and traders worry about the fall-out from the Ukrainian crisis.

Russian markets have been on a wild ride this year as investors and traders worry about the fall-out from the Ukrainian crisis.  Whether LeBron James remains with the Miami or returns to Cleveland, his ultimate goal is to become a billionaire.

Whether LeBron James remains with the Miami or returns to Cleveland, his ultimate goal is to become a billionaire.  You can now control Google Glass with pure brain power, using the new MindRDR app.

You can now control Google Glass with pure brain power, using the new MindRDR app.  Only 4 full-time reporters cover Connecticut's statehouse

Only 4 full-time reporters cover Connecticut's statehouse  Hackers from China sought information on government employees, including which personnel have security clearances.

Hackers from China sought information on government employees, including which personnel have security clearances.  Bell Labs set a new broadband Internet speed record that could change the need for Internet providers to bring fiber to the home.

Bell Labs set a new broadband Internet speed record that could change the need for Internet providers to bring fiber to the home.

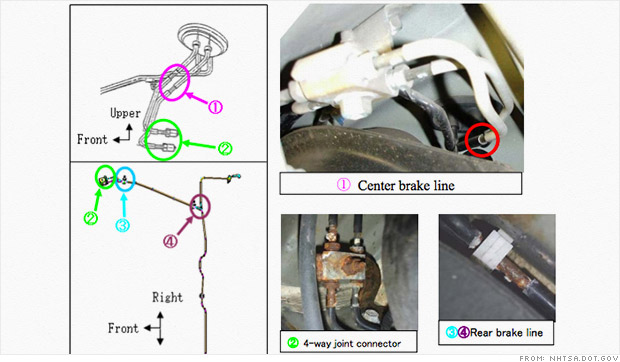

Subaru is recalling more than 660,000 vehicles for potential corrosion of the brake lines.

Subaru is recalling more than 660,000 vehicles for potential corrosion of the brake lines.  Subaru says that parts of the brake system in some models can potentially corrode from road salt, increasing the risk of a crash.

Subaru says that parts of the brake system in some models can potentially corrode from road salt, increasing the risk of a crash.