NEW YORK (CNNMoney)

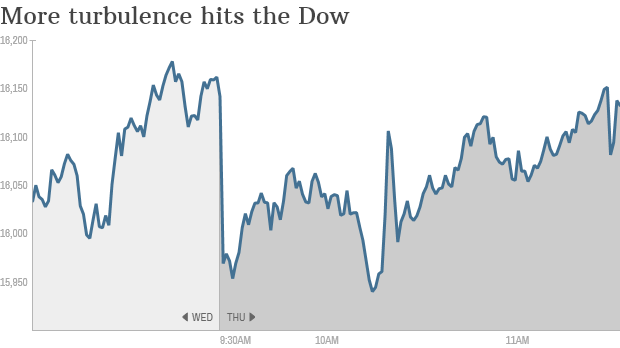

The Dow plummeted about 200 points and briefly tumbled below the 16,000 level before rebounding dramatically. Now it's down again.

So what's driving the latest craziness? The early selling was sparked by continued concerns about global growth, especially in European countries like Greece and Spain.

Then stocks bounced and even briefly turned positive on new signs the Federal Reserve could keep the easy money flowing due to the recent market turbulence. That would be very bullish for the stock market, which has soared to record highs thanks in part to the Fed's stimulus programs.

Fed officials are clearly taking notice of the extreme turbulence that has hit the markets in recent days due to fears about Europe's economy, the Ebola outbreak and plunging oil prices. Just look at Wednesday, when the Dow plummeted as much as 460 points but ended the day down "only" 173 points.

"Price action this morning is ridiculous, with currencies, commodities, interest rates, volatility markets, equities, and every other financial asset class whipping up and down almost at random," Bespoke Investment Group wrote in a note to clients.

The wave of selling over the past month has nearly wiped out the stock market's gains for the year and left all three major indexes flirting with their first "correction" in years.

If the Nasdaq closes below 4,138.37, it would officially be in correction mode, signaling a 10% decline from a previous closing high. It's currently trading around 4,207.

Related: When will companies stop hoarding cash?

Fed to the rescue?

Stocks received a mid-morning boost from a pair of Federal Reserve officials who suggested the central bank should keep pumping easy-money into the economy.

James Bullard, the St. Louis Fed president, told Bloomberg News the Fed should weigh delaying the end to quantitative easing, the bond-buying experiment that has helped send stocks to record highs.

"This big flip flop from the guy I refer to as 'the Godfather of QE' is a game changer," Michael Block, chief strategist at Rhino Trading Partners, wrote in a note to clients. "This is a powerful signal that the Fed remains accommodative and is concerned with asset prices and volatility enough to consider the seemingly unthinkable step of continuing and even growing QE from current levels."

The comments mirror similar ones from another Fed official and could ease worries about interest rate hikes that would make stocks less attractive. But they also highlight concerns about whether the Fed is running out of ammo.

Despite bouncing off its lows, the Dow is still at risk of posting its first six-day losing streak since August 2013.

European jitters mount: European growth has slowed to a near halt and some countries, including even economic powerhouse Germany, are teetering on the brink of recession.

Markets in France and Germany retreated and the U.K.'s FTSE 100 tumbled nearly 3%. Virtually all European markets are now in correction territory.

Related: This is NOT another financial crisis

New problems are also emerging in the high-debt nations on Europe's periphery. Greece's stock and bond markets have been in free fall this week over worries about the country's efforts to leave its bailout program.

Those worries have spread to Spain. Investors were alarmed by the fact that Spain held a bond auction on Thursday that failed to meet its target. That's never a good sign and highlights the aversion to risk in the markets.

These concerns help explain why crude oil has plunged 6% this week alone. Oil broke below the $80-a-barrel threshold on Thursday for the first time since June 2012 before rebounding.

Related: What the heck should the Fed do now?

Good U.S. news: There are a number of positive U.S. stories that are offsetting the gloom and doom in Europe.

For example, there's fresh evidence the job market is getting healthier. Claims for first-time unemployment benefits tumbled last week to the lowest level since April 2000.

"I think it speaks loudly about the sturdiness of the labor market. That's the underpinning of a self-sustaining economic recovery," said Mark Luschini, chief investment strategist at Janney Montgomery Scott. "The market doesn't care about that right now."

Also, a number of major companies reported quarterly earnings that exceeded expectations. Shares of Delta Air Lines (DAL) and UnitedHealth (UNH) rallied on their earnings beats.

On the other hand, Goldman Sachs (GS) dropped 2% despite reporting soaring profits and Netflix (NFLX, Tech30) plummeted over 20% on disappointing subscriber figures.

First Published: October 16, 2014: 10:37 AM ET

Anda sedang membaca artikel tentang

Turbulence: Another wild day for stocks

Dengan url

http://bolagaya.blogspot.com/2014/10/turbulence-another-wild-day-for-stocks.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Turbulence: Another wild day for stocks

namun jangan lupa untuk meletakkan link

Turbulence: Another wild day for stocks

sebagai sumbernya

0 komentar:

Posting Komentar