NEW YORK (CNNMoney)

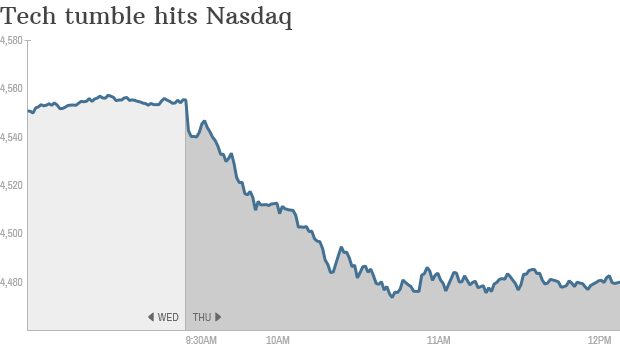

Apple (AAPL, Tech30) and other technology stocks took a tumble on Thursday, driving the Nasdaq deeply into the red.

But it's not just tech stocks under pressure. The Dow dove over 200 points and the broader S&P 500 is down 1.25%.

The sea of red puts Wall Street on track for its fourth decline in five days and erases Wednesday's big rally.

"Equity investors are concerned about the second, third and fourth largest economies in the world slowing down," said Art Hogan, chief market strategist at Wunderlich Securities, referring to trouble in China, Japan and Europe.

While the U.S. economy continues to chug along, recent economic data out of Europe suggest the continent continues to be hurt by the sanctions slapped on Russia.

The other two key economic powerhouses China and Japan continue to grapple with their own economic pressures.

Related: There's a 'death cross' in the stock market

Extreme fear: It seems fear is back in vogue on Wall Street -- just in time for Halloween.

CNNMoney's Fear & Greed Index is now flashing "extreme fear," compared with just "fear" a week ago. Very recently, this gauge was in all-out "greed" territory.

Safe haven demand, a key metric in the Fear & Greed Index, switched to "extreme fear" from "neutral" earlier this week.

It's important to remember that low trading volumes caused by the Rosh Hashanah holiday could be exacerbating the selloff. Low volume makes it harder for buyers and sellers to pair up.

Related: Fear factor - Investors are scared again

Sour Apple: One stock that's not seeing a shortage of volume is Apple. The tech giant dropped 3% on Thursday in the wake of apparent glitches with its iOS software update. Some Apple customers have also complained that the new iPhone 6 Plus is bendable.

"It's the last thing you bought so it's the first thing you sell. It's big and liquid," said Michael Block, chief strategist at Rhino Trading Partners.

Other tech stocks are also under pressure, including Apple supplier Avago Technologies (AVGO), SanDisk (SNDK) and biotech names like Celgene (CELG) and Biogen (BIIB).

Related: Zero Hedge is Wall Street's daily dose of doom & gloom

Strong dollar, weak stocks: American stocks have also been hurt by the stronger U.S. dollar, which is now trading at levels not seen in more than four years.

The greenback is rallying on signs the Federal Reserve is moving ahead with plans to raise rates next year even as other central banks are adding more juice to the easy-money punchbowl.

While a stronger dollar can be a positive in the medium to long term, it's often a short-term negative for multinational stocks and commodities like oil.

First Published: September 25, 2014: 12:01 PM ET

Anda sedang membaca artikel tentang

Tech trouble sparks wave of selling on Wall Street

Dengan url

http://bolagaya.blogspot.com/2014/09/tech-trouble-sparks-wave-of-selling-on.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Tech trouble sparks wave of selling on Wall Street

namun jangan lupa untuk meletakkan link

Tech trouble sparks wave of selling on Wall Street

sebagai sumbernya

0 komentar:

Posting Komentar