NEW YORK (CNNMoney)

Here's the story today:

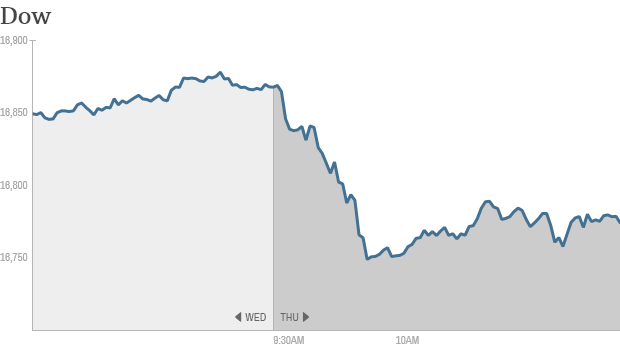

1. The numbers: The Dow Jones Industrial Average, S&P 500 and the Nasdaq all kicked off the trading session solidly lower. The Dow is down around 75 points (0.45%) with the other two indexes down around the same percent.

Trading volumes could take a hit during the middle of the day as investors turn their attention to the the soccer game, but it's not off to a good start for investors.

2. Fed fears: Stocks are slumping on concerns that the Fed will soon remove the easy-money punch bowl that's been juicing stock prices, according to key market players.

James Bullard, the president of the St. Louis Federal Reserve, warned that financial markets may not appreciate how close the central bank is to achieving its goals. Bullard told FOX Business on Thursday that a rate hike could come during the first quarter of 2015.

While the comments about a rate hike match Bullard's previous forecast, they appeared to take the market off guard because the Fed official is normally very dovish.

Block said traders may also just be repositioning their portfolios ahead of the end of the quarter on Monday.

Interestingly, the selling also occurred after FIFA announced a nine-game suspension of Uruguay's Luis Suarez after he bit an Italian opponent.

"Suarez suspension sends stocks reeling. $ES_F $YM_F $SPY," StockTwits user hap317 joked.

While stocks are solidly lower, the S&P 500 is still on track for its 49th consecutive day without a close of 1% higher or lower. That's the longest such streak since 1995.

Related: Where's the drama on Wall Street?

3. Barclays under fire: Shares of Barclays (BCS) crumbled 6.5% after the New York Attorney General unleashed a lawsuit late Wednesday against the British bank alleging a lack of transparency in some of its alternative trading platforms.

The attorney general claims the bank misled investors -- even going as far as lying in marketing materials -- about how much high-frequency trading firms were operating in Barclays "dark pool" trading platform.

"First it was gold, now it is HFT - poor $BCS just can't get away with any market rigging crime these days," StockTwits user flounder joked.

Related: NY Attorney General goes after Barclays

4. GoPro goes public with a bang: Camera maker GoPro (GPRO) has already shown it can withstand drops from space and close encounters with sharks. Now we'll see how the gadget company grapples with life on Wall Street. So far, so good.

GoPro kicked off life as a public company by popping 19% above its initial public offering price of $24. The consumer electronics company ithen surged even higher with shares trading around $31.

GoPro, which is trading on the Nasdaq under the ticker symbol "GPRO," raised about $425 million in the offering. The IPO priced at the high end of the expected range of $21 to $24.

Related: Fear & Greed Index

5. Movers & shakers - Alcoa, Bed Bath & Beyond, Philip Morris: It's shaping up to be an ugly day for Bed Bath & Beyond (BBBY). The home goods retailer tumbled 9% on after earnings came in lower than expected, and the retailer doesn't forecast it will get much better the rest of the year.

Philip Morris International (PM) was also stuck in reverse, losing almost 3%, after the cigarette maker dimmed its forecast for the year due to currency troubles and economic challenges in Europe.

On the other hand, Alcoa (AA) bounced 2% after unveiling a $2.85 billion cash-and-stock deal to acquire Firth Rixson, which makes jet-engine parts. The move should help Alcoa diversify amid anemic aluminum prices.

Nabors Industries (NBR) soared 7% after inking a $2.86 billion deal to combine one of its units with C&J Energy Services. Both companies are key players in getting oil and natural gas wells ready to go.

Nike (NKE) is scheduled to hit the earnings stage after the closing bell.

6. Economic data: Investors will keep an eye on consumer discretionary stocks after the government said consumer spending inched up just 0.2% in May, trailing forecasts for a 0.4% rise. Spending for April was upgraded from a contraction to a 0.1% increase. Personal income rose 0.4%, as expected.

Also, new data showed unemployment claims dipped to 312,000 last week from an upwardly revised 314,000 the week before.

Related: CNNMoney's Tech30

7. International markets looking chipper: European markets mostly retreated, while Asian markets largely ended with gains. The Hang Seng in Hong Kong was a standout performer -- rising by 1.4% during the day.

Gold prices were also declining by roughly 0.5%. Prices for the shiny metal tend to rise when investors are feeling nervous, and tend to fall when investors are feeling confident. Oil prices also dipped slightly.

First Published: June 26, 2014: 9:55 AM ET

Anda sedang membaca artikel tentang

Stocks head South on rate hike fears

Dengan url

http://bolagaya.blogspot.com/2014/06/stocks-head-south-on-rate-hike-fears.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks head South on rate hike fears

namun jangan lupa untuk meletakkan link

Stocks head South on rate hike fears

sebagai sumbernya

0 komentar:

Posting Komentar