Click image for more market data

NEW YORK (CNNMoney)

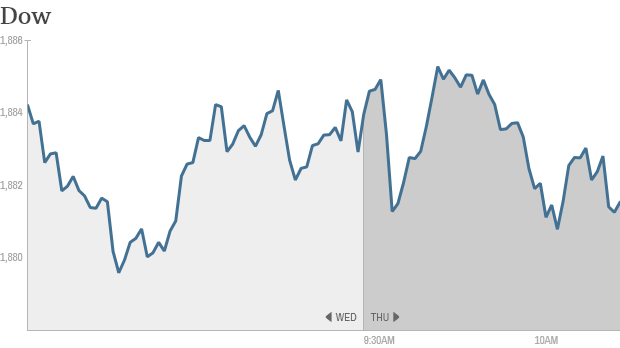

Stocks started the month on an apprehensive note as investors digest the latest stream of earnings reports, economic indicators and yesterday's record high for the Dow Jones industrial average.

In early trading, the Dow, S&P 500 and Nasdaq were trading flat to slightly lower. The S&P 500 needs to close just 7 points higher to notch a new all-time record, but it's not doing much to get there thus far.

Earnings "haven't been very strong, but they've been good enough to assuage people's fears," said financial analyst Peter Leeds.

There's been plenty of action in individual stock names as investors try to sort out the truly valuable from the rest.

Related: Top 20 stable stocks to buy now

MasterCard (MA, Fortune 500) rallied 2% after the card giant logged stronger-than-expected results powered by double-digit volume growth. ExxonMobil (XOM, Fortune 500) flirted with record highs as investors cheered the energy giant's big earnings beat and largely overlooked a modest revenue miss.

Shares of Avon Products (AVP, Fortune 500) tumbled 12% as investors fretted about the cosmetic company's big earnings miss amid an 11% drop in revenue. Avon also put to bed a long-running bribery probe by agreeing to pay $135 million in fines to U.S. regulators.

To give a sense of how not glamorous things are for Avon right now, the stock is rading at $13.40, lower than its worst dip during the recession.

Sony Corp (SNE) slumped 4% after slashing its profit outlook and projecting a first-quarter loss. LinkedIn (LNKD) and Kraft Foods (KRFT, Fortune 500) are set to report after the close, among others.

Related: CNNMoney's Tech30

Shares of DirectTV (DTV, Fortune 500) spiked 5% on talk that AT&T (T, Fortune 500)may be making a bid for the satellite TV company. T-Mobile US (TMUS) popped 7% amid renewed speculation of a tie-up with Sprint (S, Fortune 500). T-Mobile, the fourth largest U.S. wireless provider, also said it added 1.3 million subscribers in the first quarter, although that didn't prevent a loss of $151 million.

Confirming recent reports, Ford (F, Fortune 500) said CEO Alan Mulally will step down on July and be succeeded by Mark Fields, who has served as chief operating officer since late 2012. Also, KFC and Pizza Hut owner Yum Brands (YUM, Fortune 500) said Taco Bell CEO Greg Creed will replace David Novak in January.

Related: Fear & Greed Index still gripped by fear

On the economic front, the Institute for Supply Management's index on U.S. manufacturing climbed above forecasts in April, indicating a pickup in activity.

The Labor Department said initial jobless claims climbed to a nine-week high of 344,000 last week, well ahead of estimates. The government also said consumer spending jumped by a stronger-than-expected 0.9% in March, the fastest pace since August 2009.

But the focus will shift after the closing bell to the government's all important jobs report. Economists predict the U.S. added 210,000 new jobs in April, bringing the unemployment down to 6.6% from 6.7%.

The turn in the calendar to May allows investors the chance to revisit a favorite argument: Does it make sense to sell in May and go away?

The May-to-October period is considered the worst six months for stocks, with the S&P 500 gaining just 1.3% over that period in the past 50 years, compared with 7.1% in the other six months. Analysts have said that poor track word could be exacerbated by the fact that it's a mid-term election year.

Related: Get ready for the summer bummer on Wall Street

Most of the major European markets were closed for a holiday Thursday, but the U.K. exchanges were open. The FTSE 100 edged higher, led by Lloyds Banking Group (LLDTF). The British bank reported first-quarter results that impressed investors.

Most Asian markets were also closed, but Japan and Australia were open for business. Japan's Nikkei index popped up by 1.3%, while Australia's ASX All Ordinaries index dipped by 0.7%. ![]()

First Published: May 1, 2014: 9:44 AM ET

Anda sedang membaca artikel tentang

Wall Street starts May without enthusiasm

Dengan url

http://bolagaya.blogspot.com/2014/05/wall-street-starts-may-without.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Wall Street starts May without enthusiasm

namun jangan lupa untuk meletakkan link

Wall Street starts May without enthusiasm

sebagai sumbernya

0 komentar:

Posting Komentar