Click for more market data.

NEW YORK (CNNMoney)

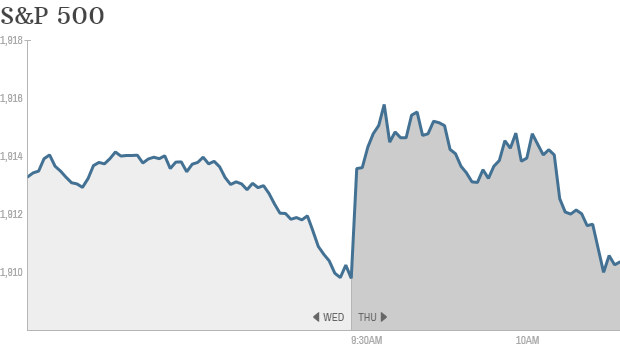

The Dow Jones industrial average, the S&P 500 and the Nasdaq were all modestly higher in late-morning trading. The S&P 500 shot to nearly 1,916 after the opening bell, another intraday trading record for the index. But the gains did not hold.

Rush of economic data: The U.S. economy shrank at a 1% annual rate in the first three months of the year, according to revised data released Thursday. That was much worse than the initial 0.1% reading, and reflected a sharp drop in inventory spending by businesses.

But economists downplayed the report, saying more recent indicators suggest the economy has improved in the current quarter. For example, the latest report on weekly jobless claims showed a sharp drop in the number of people filing for unemployment benefits.

Investors love bonds: Investors continue to show a strong appetite for bonds. The yield on the 10-year Treasury note fell to 2.41%, the lowest level since June 2013. Bonds have rallied as investors grow convinced that the Federal Reserve will not hike interest rates any time soon.

Here are the top moving stocks today:

A game of chicken? Shares of Hillshire Brands (HSH, Fortune 500) surged 15% after Tyson Foods (TSN, Fortune 500) unveiled a $6.8 billion buyout offer. The move comes days after Pilgrim's Pride (PPC) launched a bid to buy Hillshire for $6.4 billion. The packaged food companies are hungry to form one of the world's largest producers of meat, chicken and pork products.

Beats and BlackBerry. Apple (AAPL, Fortune 500) shares were modestly higher after the technology giant announced that it was buying headphone-maker Beats for $3 billion. News of the deal had been circulating for nearly three weeks.

Shares of BlackBerry (BBRY) gained as investors welcomed comments from CEO John Chen at Recode's Code Conference. He said the company has an 80% chance of coming back (higher than his previous 50-50 estimate) and reiterated that BlackBerry isn't dead yet.

Related: Fear & Greed Index still languishing in fear

Retail in focus again. Costco (COST, Fortune 500) issued its latest quarterly results, showing that sales increased but profit came in slightly below expectations. The stock is up modestly.

Abercrombie & Fitch (ANF) shares surged more than 5% in early trading, even though the clothing retailer reported a quarterly loss.

"In what remains a difficult teen retail environment, we are pleased that earnings for the quarter were in line with our expectations," said Chief Executive Officer Mike Jeffries.

Retailers Guess (GES) and Pacific Sunwear (PSUN) will report after the close. Despite a 27% drop in share price yesterday, DSW (DSW) stock stabilized today.

Related: CNNMoney's Tech30

European markets were mixed in the final hour of trading. Asian markets mostly closed in the red Thursday.

Japan's Nikkei index bucked the trend and edged up by 0.1%. Japanese investors shrugged off retail sales data from April showing consumers were cutting back on their shopping after a sales tax hike. ![]()

First Published: May 29, 2014: 9:59 AM ET

Anda sedang membaca artikel tentang

Stocks up. Investors shrug off weak GDP

Dengan url

http://bolagaya.blogspot.com/2014/05/stocks-up-investors-shrug-off-weak-gdp.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks up. Investors shrug off weak GDP

namun jangan lupa untuk meletakkan link

Stocks up. Investors shrug off weak GDP

sebagai sumbernya

0 komentar:

Posting Komentar