Anatomy of a trade

(Fortune)

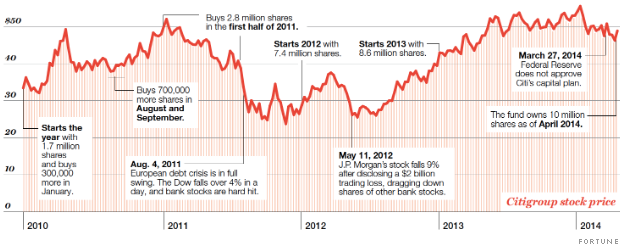

1. The stock is undervalued

When Holt began buying Citi shares in late 2009, the company was so tarnished that the stock traded for little more than half the value of Citi's tangible assets. That ratio of price to tangible book value has stepped up from 0.6 to 0.8 today. Despite that improvement, Citi still trades at a significant discount to rivals Bank of America (1.2) and J.P. Morgan Chase (1.4). As Citi continues to address its problems (see item 2) and the stain of its past stumbles is erased over a period of years, Holt thinks the company will be able to achieve a ratio in line with its peers'.

Anda sedang membaca artikel tentang

Banking on Citigroup

Dengan url

http://bolagaya.blogspot.com/2014/05/banking-on-citigroup.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Banking on Citigroup

namun jangan lupa untuk meletakkan link

sebagai sumbernya

0 komentar:

Posting Komentar