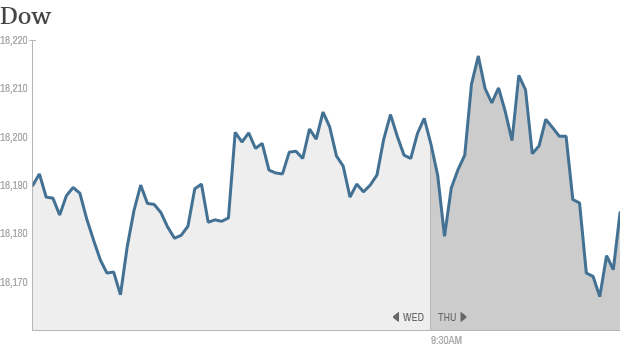

Click the chart for more markets data.

NEW YORK (CNNMoney)

The Dow, S&P 500, and Nasdaq closed little changed Wednesday. But the S&P 500 is still close to its record high.

Investors around the world are once again turning to the Fed for clues about monetary policy.

Yellen testified before the Senate Banking Committee this morning. The Fed began dialing back its unprecedented stimulus in December, and is currently purchasing $65 billion in bonds per month, down from a monthly $85 billion last year.

Market strategists expect the Fed to keep scaling back its bond-buying program, but will be listening in to Yellen for hints about when the central bank may raise interest rates. The Fed has maintained that interest rates will stay low for some time, but minutes from its January meeting showed some internal debate within the Fed about whether rates should be raised sooner rather than later.

Yellen was originally scheduled to speak two weeks ago when she also testified before the House, but her appearance was delayed due to bad weather. Stocks rallied following her comments two weeks ago.

Related: CNN coverage of Ukraine crisis

Investors were also keeping a close eye on the tension in Ukraine. European markets were under pressure in afternoon trading as traders fretted about the formation of a new Ukrainian government and its increasingly dire economic situation. Asian markets ended with mixed results.

In corporate news, investors seemed to like what they're hearing from some struggling retailers.

Shares of J.C. Penney (JCP, Fortune 500) soared more than 21% after the retailer reported a narrower-than-expected quarterly loss and said it expects same-store sales to rise by 3% to 5% during the current quarter. After a rough few years, investors may be getting hopeful that the company can finally deliver on its much-hyped turnaround strategy.

Related: Fear & Greed Index shifts back to neutral

Best Buy (BBY, Fortune 500) shares also jumped after the electronics retailer reported quarterly earnings that had returned to profit from earlier losses. The company has experienced its fair share of problems in recent years as consumers have turned to online shopping.

Tesla (TSLA) shares initially got a boost Thursday after the automaker announced it was raising $1.6 billion to fund its expansion plans. But shares pulled back were lower in mid-morning trading. Still. the electric car company's stock has soared almost 50% in the past month and hit a high of $265 per share Wednesday.

Shares of Chinese search engine Baidu (BIDU) popped after the company posted solid earnings and sales. The stock was the best performer in CNNMoney's Tech 30 index. ![]()

First Published: February 27, 2014: 9:56 AM ET

Anda sedang membaca artikel tentang

Stocks: Yellen and retailers in focus

Dengan url

http://bolagaya.blogspot.com/2014/02/stocks-yellen-and-retailers-in-focus.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks: Yellen and retailers in focus

namun jangan lupa untuk meletakkan link

Stocks: Yellen and retailers in focus

sebagai sumbernya

0 komentar:

Posting Komentar