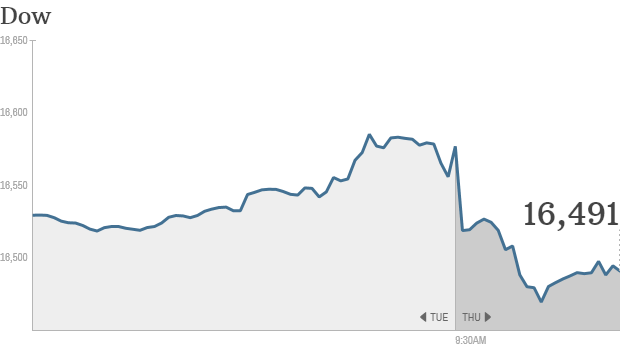

Click the chart for more stock market data.

NEW YORK (CNNMoney)

The Dow, S&P 500 and Nasdaq were between 0.4% and 0.6% lower Thursday. If stocks finish the day in the red, it would be the first time the markets started the year on a down note since 2008.

Investors were in a cautious mood after data showed that China's factories lost some momentum in December, adding to fears that the world's second-largest economy may soften in the new year.

Economic data in the United States wasn't all that positive either. Manufacturing activity grew in December, but at a slightly slower pace than the previous month, according to the Institute for Supply Management's index. Initial jobless claims fell for a second straight week but came in slightly higher than expectations.

Related: Click here for more on stocks, bond, currencies and commodities

Trading volume will likely remain light as many traders are still away for the holidays.

On the corporate front, shares of Fiat (FIADF) jumped 14% in Milan after the Italian automaker announced Wednesday it was buying full control of Chrysler.

A series of upgrades and downgrades from Wall Street analysts sent a number of big stocks moving.

Shares of Apple (AAPL, Fortune 500) slid after Wells Fargo downgraded the iPhone maker to "market-perform" from "outperform."

Sprint (S, Fortune 500) moved lower following a downgrade from Cowen & Co.

A downgrade from Jefferies sent shares Abercrombie & Fitch (ANF) lower, while an upgrade of Urban Outfitters (URBN) boosted that retailer's shares.

Bank of America (BAC, Fortune 500) shares gained ground after Citigroup analysts upgraded the stock to a "buy" from "neutral."

While most stocks were lower Thursday, gold started off on a strong note, rising almost 2%. The precious metal fell 28% in 2013, marking the first down year for gold prices since 2000. As gold priced advanced, shares of Newmont Mining (NEM, Fortune 500) and other gold miners surged.

Related: Fear & Greed Index shifts into Extreme Greed

U.S. stocks finished higher Tuesday -- the final trading day of 2013 -- with the Dow and S&P closing out 2013 with record highs. The Dow ended the year with a 26% gain, while the S&P 500 jumped more than 29% and the Nasdaq surged nearly 40%.

Markets were closed around the world Wednesday for the New Year's holiday.

Related: Which world markets will be hot in 2014?

European markets were all moving lower in afternoon trading, with France's CAC 40 index declining by 1%.

Most Asian markets ended the day with small gains. The Shanghai Composite index moved up nearly 1%. The Tokyo Stock Exchange was closed for an extended New Year break. ![]()

First Published: January 2, 2014: 9:41 AM ET

Anda sedang membaca artikel tentang

Stocks start 2014 in the red

Dengan url

http://bolagaya.blogspot.com/2014/01/stocks-start-2014-in-red.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks start 2014 in the red

namun jangan lupa untuk meletakkan link

sebagai sumbernya

0 komentar:

Posting Komentar