Click the chart for more stock market data.

NEW YORK (CNNMoney)

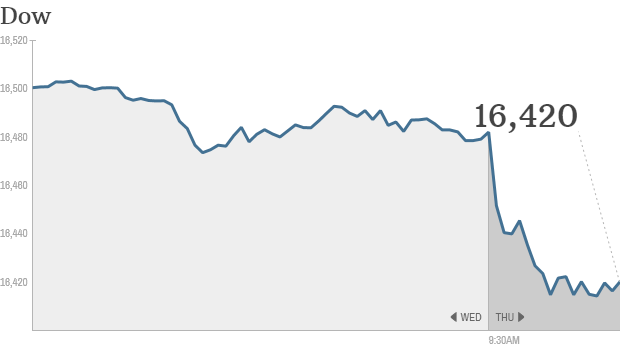

Stocks started the day lower, with the S&P 500 pulling back from the record highs reached Wednesday. The Dow and Nasdaq declined slightly. CNNMmoney's Tech 30 index was also lower.

Best Buy (BBY, Fortune 500) was the biggest loser in the S&P 500, with shares tumbling almost 30% in the early going. Investors were disappointed after the retailer reported a drop in holiday sales.

Also in the retail world, shares of J.C. Penney (JCP, Fortune 500) declined after the troubled department store owner announced plans to eliminate 2,000 jobs and close 33 stores.

Investors were also wading through a number of quarterly results Thursday, including reports from banks Goldman Sachs (GS, Fortune 500) and Citigroup (C, Fortune 500).

Citigroup's earnings were the first from the big six banks to disappoint investors. Shares declined more than 3% after reporting earnings and revenue that fell short of expectations.

Goldman Sachs' earnings were better than analysts' forecasts, but shares were also lower as the bank's profit in the last three months of 2013 fell 19% from a year earlier.

Shares of railroad CSX (CSX, Fortune 500) fell sharply after the company said its profit declined during the fourth quarter due to weak coal demand. Shares of rival railroads Norfolk Southern (NSC, Fortune 500) and Union Pacific (UNP, Fortune 500), which report results next week, were also down.

Intel (INTC, Fortune 500) and American Express (AXP, Fortune 500) are scheduled to report results in the afternoon.

Related: Follow CNNMoney's Tech 30

In other corporate news, shares of Hewlett-Packard (HPQ, Fortune 500) moved higher as investors grew optimistic about the firm's plans to sell some new tablets in the Indian market. It was a big winner in the Tech 30 index.

CEC Entertainment, (CEC) the owner of Chuck E. Cheese, announced that private equity firm Apollo Global Management (APO) was buying it for $1.3 billion.

Related: Fear & Greed Index continues to show Greed

On the economic front, filings for initial jobless claims fell last week. A reading on consumer prices for December showed that inflation remains tame.

European and Asian markets posted mixed results. ![]()

First Published: January 16, 2014: 9:52 AM ET

Anda sedang membaca artikel tentang

Bad corporate news sends stocks lower

Dengan url

http://bolagaya.blogspot.com/2014/01/bad-corporate-news-sends-stocks-lower.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Bad corporate news sends stocks lower

namun jangan lupa untuk meletakkan link

Bad corporate news sends stocks lower

sebagai sumbernya

0 komentar:

Posting Komentar