Click the chart for more stock market data.

NEW YORK (CNNMoney)

The stock began trading at $45.10, 73% above its initial public offering price of $26, shortly before 11 a.m. ET. Twitter continued to rise, climbing as high as $50.09, with more 50 million shares exchanging hands within the first half hour of trading.

Though Twitter was sharply higher, rival social media sites Facebook (FB, Fortune 500) and LinkedIn (LNKD) were down 3%. The Social Media ETF (SOCL), which is expected to purchase shares of Twitter for its fund, was down almost 4%.

Two mutual funds that invest in private companies and have owned Twitter shares for some time were also down sharply. GSV Capital (GSVC) fell more than 10%, while shares of Firsthand Technology Value Fund (SVVC) declined 7%.

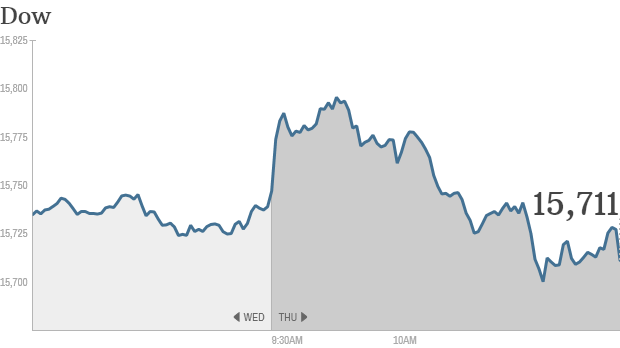

Meanwhile, the broader market was lower even after stocks opened at record highs as in investors initially welcomed solid economic data and a surprise rate cut from the European Central Bank.

The Dow Jones industrial average fell 0.5%, while the S&P 500 slipped 0.7%. The Nasdaq was the biggest laggard of the day, down more than 1%.

Earnings continue to roll in: The broader markets were being dragged down by companies with lackluster earnings.

Whole Foods (WFM, Fortune 500)was one of the biggest laggards in the S&P 500 and Nasdaq as shares sank more than 10%. The sharp drop came after organic grocer cut its earnings and sales forecasts.

Qualcomm (QCOM, Fortune 500) was also weighing on the Nasdaq and S&P 500, as shares fell 4% after the company posted quarterly earnings that fell short of expectations.

Walt Disney (DIS, Fortune 500), Groupon (GRPN) and Priceline.com (PCLN, Fortune 500) are set to report quarterly results after the market close.

Tesla (TSLA) shares tumbled again following reports of yet another fire in one of its Model S electric cars.

J.C. Penney (JCP, Fortune 500), however, jumped after the troubled retailer announced an increase in same-store sales for October.

Related: Fear & Greed Index is back to extreme greed

Upbeat economic data: Investors were initially encouraged by a report that showed the U.S. economy perked up slightly this summer, driven largely by businesses re-stocking their shelves, a rise in consumer spending, and the ongoing housing recovery.

Gross domestic product -- the broadest measure of economic activity -- rose at a 2.8% annual rate in the third quarter, according to the Bureau of Economic Analysis. That marked the fastest growth in a year and was stronger than economists had anticipated.

A separate report showed initial jobless claims declined for the fourth straight week, falling by 9,000 to 336,000.

ECB unexpectedly cuts rates: In Europe, it's all about the European Central Bank. The ECB said it cut a key interest rate to 0.25%, a sign of how fragile the European economic recovery is. European stock markets made modest gains in afternoon trading, keeping them near five-year highs. ![]()

First Published: November 7, 2013: 9:45 AM ET

Anda sedang membaca artikel tentang

Stocks turn sour as investors await Twitter

Dengan url

http://bolagaya.blogspot.com/2013/11/stocks-turn-sour-as-investors-await.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks turn sour as investors await Twitter

namun jangan lupa untuk meletakkan link

Stocks turn sour as investors await Twitter

sebagai sumbernya

0 komentar:

Posting Komentar