Click chart for more markets data.

NEW YORK (CNNMoney)

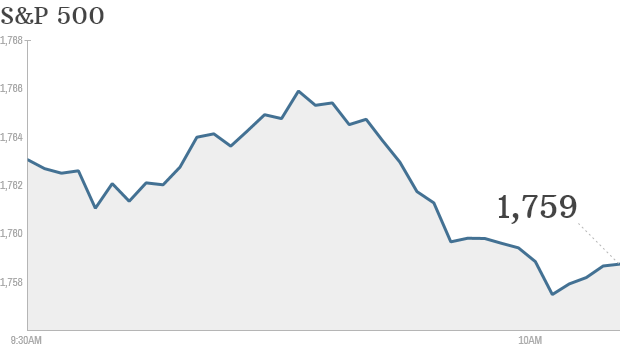

Stocks fell modestly Thursday morning, one day after the Federal Reserve said that it will do exactly what the market wanted. The Fed will keep buying $85 billion a month in bonds.

The Dow, S&P and Nasdaq all dipped after the announcement late Wednesday, coming off of all-time highs.

Related: Fear & Greed Index still shows greed

Investors around the globe also appear to be suffering from rally fatigue. European markets were mixed in afternoon trading and nearly all Asian markets ended in the red.

The Fed's bond buying program has been a catalyst for an epic stock market run this year, but investors now seem to need more compelling reasons to keep pushing stocks higher.

Some investors had hoped the Fed would mention what impact the recent government shutdown had on economic growth. If the Fed sounded more negative about the economy, that might have been interpreted as a sign that the central bank may keep buying bonds well into 2014.

Still, even though the last day of October looks more like a trick than a treat, the S&P 500 has rallied nearly 5% this month, and the Dow Jones Industrial Average has run up more than 3%. It's been Rocktober as opposed to Shocktober.

Related: Are investors joining rally too late?

Facebook's reversal hurts Nasdaq: Facebook (FB, Fortune 500) faked out investors Wednesday night. The social media site's stock spiked 15% after hours when it announced that earnings and revenues easily beat forecasts thanks to strong mobile growth. But investors became spooked when the company said during its conference call that the number of teen users who were visiting the social networking site on a daily basis had fallen.

Facebook's stock fell in early morning trading.

China's Craigslist is booming: China's equivalent of Craigslist, 58.com (WUBA), debuted Thursday, and shares quickly shot up more than 40%.

Expedia's (EXPE) stock jumped more than 18% on better-than-expected earnings.

Exxon Mobil (XOM, Fortune 500) reported a sharp drop in profits but the oil company's shares still rallied Thursday.

Estee Lauder (EL, Fortune 500)'s shares rose after the makeup company reported an uptick in third quarter sales.

AB InBev (BUD), the brewer of Anheuser Busch, reported Wednesday that sales and profit jumped in the third quarter. ![]()

First Published: October 31, 2013: 9:52 AM ET

Anda sedang membaca artikel tentang

Stocks fall on Fed hangover

Dengan url

http://bolagaya.blogspot.com/2013/10/stocks-fall-on-fed-hangover.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks fall on Fed hangover

namun jangan lupa untuk meletakkan link

sebagai sumbernya

0 komentar:

Posting Komentar