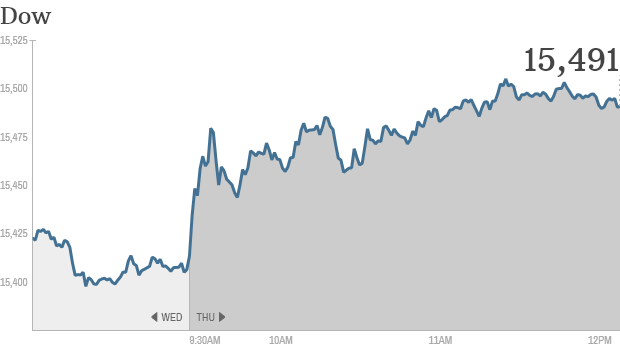

Click the chart for more stock market data.

NEW YORK (CNNMoney)

The Dow Jones industrial average, the S&P 500 and Nasdaq were modestly higher in afternoon trading.

In a sign that manufacturing is improving in the world's second largest economy, Chinese factory activity hit a 7-month high in October. The positive data follows last week's upbeat report that showed China's economy great 7.8% during the third quarter.

A big day for earnings: Dow components 3M (MMM, Fortune 500) and AT&T (T, Fortune 500) reported better-than-expected earnings. But shares of Ma Bell were down 1% while 3M rose slightly.

Ford (F, Fortune 500) shares rallied after the automaker raised guidance and released quarterly earnings and revenue that topped forecasts. Rival GM (GM, Fortune 500) rose on the news as well. Investors were particularly encouraged by the fact that Ford once again trimmed its ongoing losses in Europe and raised its earnings guidance.

"Second consecutive upside surprise from Europe at Ford," said StockTwits user retail_guru. "Faster improvement = unqualified great news $F."

On Ford's earnings call with analysts, CEO Alan Mulally also tried to ease concerns that he may leave the automaker to take the top job at Microsoft (MSFT, Fortune 500).

PulteGroup (PHA) shares were also on the rise after the homebuilder's earnings and revenue topped forecasts.

Southwest Airlines (LUV, Fortune 500) gained ground after the discount airline reported solid earnings thanks to higher airfares and declining fuel costs. Southwest was optimistic about the current quarter, highlighting that bookings for November and December are strong.

On the downside, shares of Symantec (SYMC, Fortune 500) got hammered after the company reported earnings and sales that fell short of estimates, and slashed its guidance. The chairman of StockTwits noted that Symantec has not been as adept as Adobe (ADBE) in adapting to new trends.

"$SYMC thank goodness i gave up on this a few weeks ago...have not made the $ADBE like transition to mobile and the cloud...ugh," said howardlindzon.

Dow Chemical (DOW, Fortune 500) shares were also under pressure after the company's earnings fell short.

Microsoft (MSFT, Fortune 500), Zynga (ZNGA) and Amazon (AMZN, Fortune 500) are due to report results in the afternoon.

Related: Fear & Greed Index still shows greed

Meanwhile, shares of Appl (AAPL, Fortune 500)moved higher following the news that activist investor Carl Icahn sent a letter to CEO Tim Cook reiterating his push for a big share buyback. Icahn said he boosted his stake in the company to 4.73 million shares, and remains convinced that apple should launch a $150 billion buyback program.

Traders seemed to be on board with Icahn, and are looking forward to Apple's earnings next week.

"$AAPL starting to move like it used to with Icahn calling buyback a "no brainer," said StkCon. "Now, let's hope for good earnings!"

Some traders had lofty predictions.

"$AAPL With the blow out earnings it will rocket to $600.00 by Christmas," predicted fishobass182.

"$AAPL I love being part of history, a year from now will look back and say wow what an epic run post/ after earnings that was. Bullish," said win2betmore. ![]()

First Published: October 24, 2013: 9:54 AM ET

Anda sedang membaca artikel tentang

Solid earnings and China data lift stocks

Dengan url

http://bolagaya.blogspot.com/2013/10/solid-earnings-and-china-data-lift.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Solid earnings and China data lift stocks

namun jangan lupa untuk meletakkan link

Solid earnings and China data lift stocks

sebagai sumbernya

0 komentar:

Posting Komentar