Click the chart for more stock market data.

NEW YORK (CNNMoney)

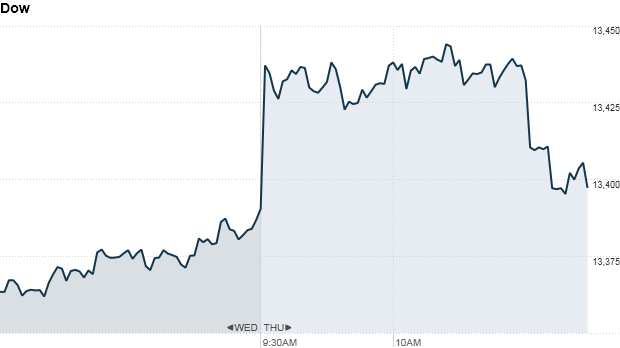

The Dow Jones industrial average, S&P 500 and Nasdaq gained between 0.1% and 0.2%.

Financials were among the biggest winners, with Bank of America (BAC, Fortune 500) leading the gains on the Dow.

Exports rose 14% in December, China's government said in a report that topped expectations.

"The strong pick in Chinese trade numbers suggests that global demand remains more robust than the consensus view, as consumers in both Europe and North America continue to spend despite economic and political problems in both regions," said Boris Schlossberg of BK Asset Management.

Investors also remained tuned into earnings reports. Shares of Supervalu (SVU, Fortune 500) jumped after the grocery store chain swung to a fiscal third-quarter profit. Supervalu also announced that it will sell Jewel-Osco, Albertson's and some of its other grocery store chains to Cerberus Capital Management, a New York-based investment firm, for $3.3 billion.

Shares of Nokia (NOK) rallied after the phone company reported better-than-expected sales for its handset business.

Related: Earnings: Banks will lead growth

Overall, analysts expect earnings for companies in the S&P 500 to grow 2.4% year-over-year, according to FactSet Research, with banks expected to lead the way.

Wells Fargo (WFC, Fortune 500) will report Friday, making it the first major financial institution to release fourth-quarter figures.

A better-than-expected start to the corporate earnings deluge caused stocks to end higher Wednesday.

In other corporate news, nutritional supplement company Herbalife (HLF) is hosting an investor conference to rebut charges from hedge fund manager Bill Ackman that it's running a pyramid scheme. Herbalife executives were confident in the company's defense, saying it's a "legitimate company with legitimate customers."

Related: Herbalife comes out swinging

Shares of Tiffany & Co (TIF) declined after the luxury retailer said sales during the holiday season rose just 4% worldwide, at the low-end of the company's expectations. Tiffany said it now expects its full-year profit to be at the lower end of its prior forecast of $3.20 to $3.40 a share. The company also said earnings growth in 2013 will be subdued due to uncertainty about the economy in all of its major markets.

Investors also digested fresh data on the labor market Thursday. The number of people filing for initial jobless claims rose 4,000 to 371,000 in the latest week.

A separate report showed that wholesale inventories rose 0.6% in November, which was higher than expected.

Fear & Greed Index

European markets were higher in afternoon trading. Both the European Central Bank and the Bank of England held interest rates at record lows on Thursday morning.

Asian markets ended higher following positive trade data from China. The Shanghai Composite added 0.4%, the Nikkei advanced 0.7% and the Hang Seng jumped 0.6%.

The dollar fell against the euro and the pound, but gained ground versus the Japanese yen.

Oil and gold prices edged higher.

The price of the 10-year Treasury declined, pushing the yield up to 1.90% from 1.85% late Wednesday. ![]()

First Published: January 10, 2013: 10:03 AM ET

Anda sedang membaca artikel tentang

Stocks get early boost from China data

Dengan url

http://bolagaya.blogspot.com/2013/01/stocks-get-early-boost-from-china-data.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Stocks get early boost from China data

namun jangan lupa untuk meletakkan link

Stocks get early boost from China data

sebagai sumbernya

0 komentar:

Posting Komentar