Click for more market data.

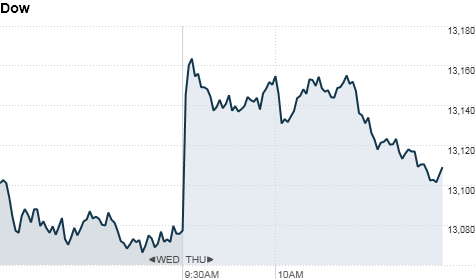

NEW YORK (CNNMoney) -- U.S. stocks were mixed in midday trading Thursday as investors focused on solid economic data but mixed corporate results.

The Dow Jones Industrial Average edged down 0.1%. The S&P 500 and Nasdaq both gained 0.1%.

Procter & Gamble (PG, Fortune 500) was the biggest gainer on the Dow after it reported mixed quarterly results, but maintained its outlook for the full year. Rival consumer products maker Colgate (CL, Fortune 500) said sales fell in the most recent quarter and announced a restructuring plan that includes cutting its workforce by 6% over the next four years. Shares fell 3% in midday trading.

Unilever (UL), another consumer name, reported solid third-quarter results as growth in emerging markets offset weakness in developed economies.

ConocoPhillips (COP, Fortune 500) said earnings fell 31% in the third quarter as oil prices sank.

Sprint (S, Fortune 500) reported a net loss in the third quarter that widened from the same period last year. Tech giants Apple (AAPL, Fortune 500) and Amazon (AMZN, Fortune 500) will report after the bell.

Related: Fear & Greed Index dips back into fear

Earnings expectations were low, but the third quarter is still shaping up to be a disappointment, said David Levy, a portfolio manager at Kenjol Capital Management in Austin, TX.

"Overall, earnings are the main reason the market has been stuck in a rut for the last ten days," said Levy.

At the same time, the market has been stymied by uncertainty ahead of the U.S. presidential election and concerns about the economic time bomb known as the fiscal cliff.

But Thursday's economic reports offered a silver lining. The government said first-time claims for unemployment benefits fell more than expected last week, to 369,000. Reports on durable goods and pending home sales in September also came in above expectations.

Investors have also been encouraged by signs of progress in Europe, where officials are expected to push ahead with plans to give Greece more time to meet its budget goals, said David Lutz, head ETF trader at Stifel Nicolaus in St. Louis.

"Some of the stress is coming off in the eurozone," said Lutz, adding that stocks are also benefiting from a rotation of money out of U.S. Treasuries.

Related: 5 hot emerging market blue chips

The UK government reported that the gross domestic product grew 1% in the third quarter, lifting the nation's economy out of recession.

European markets were mixed in afternoon trading. Britain's FTSE 100 rose 0.1% and the DAX in Germany added 0.4%. France's CAC 40 fell 0.3%.

Meanwhile, Asian markets ended mixed. The Shanghai Composite lost 0.7%, while the Hang Seng in Hong Kong gained 0.2%. The Nikkei jumped 1.1% on hopes the Bank of Japan will ease monetary policy when it meets next week.

Companies: Zynga (ZNGA) shares surged after the social gaming firm reported sales on Wednesday that topped forecasts. Zynga also announced a partnership with bwin.party, an international gaming operator that will enable real money casino games like poker, slots and roulette in the UK.

Shares of F5 Networks (FFIV) sank after the network technology firm reported quarterly earnings Wednesday that missed expectations.

Meanwhile, online security firm Symantec (SYMC, Fortune 500) jumped after offering strong guidance for the current quarter.

Shares of BestBuy (BBY, Fortune 500) fell after the retailer on Wednesday warned that third-quarter sales would be weaker than expected, and announced a management shakeup.

Currencies and commodities: The dollar fell against the euro and the British pound, but gained against the Japanese yen.

Oil for December delivery rose 1 cent to $85.75 a barrel.

Gold futures for December delivery rose $14.30 to $1,716 an ounce.

Bonds: The price on the benchmark 10-year U.S. Treasury fell, pushing the yield up to 1.85% from 1.78% late Wednesday. ![]()

First Published: October 25, 2012: 9:42 AM ET

Anda sedang membaca artikel tentang

Earnings keep stocks 'stuck in a rut'

Dengan url

http://bolagaya.blogspot.com/2012/10/earnings-keep-stocks-stuck-in-rut.html

Anda boleh menyebar luaskannya atau mengcopy paste-nya

Earnings keep stocks 'stuck in a rut'

namun jangan lupa untuk meletakkan link

Earnings keep stocks 'stuck in a rut'

sebagai sumbernya

0 komentar:

Posting Komentar